A Comprehensive Guide To Calculating Household Assets: Understanding Your Financial Worth

A Comprehensive Guide to Calculating Household Assets: Understanding Your Financial Worth

Related Articles: A Comprehensive Guide to Calculating Household Assets: Understanding Your Financial Worth

Introduction

With great pleasure, we will explore the intriguing topic related to A Comprehensive Guide to Calculating Household Assets: Understanding Your Financial Worth. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: A Comprehensive Guide to Calculating Household Assets: Understanding Your Financial Worth

- 2 Introduction

- 3 A Comprehensive Guide to Calculating Household Assets: Understanding Your Financial Worth

- 3.1 Defining Household Assets: A Foundation for Evaluation

- 3.2 The Importance of Accurate Asset Valuation: Unveiling Financial Clarity

- 3.3 Practical Steps to Calculate Household Asset Value: A Detailed Guide

- 3.4 FAQs: Addressing Common Concerns about Calculating Household Assets

- 3.5 Tips for Effective Asset Valuation: Maximizing Accuracy and Insight

- 3.6 Conclusion: Empowering Financial Decisions Through Asset Valuation

- 4 Closure

A Comprehensive Guide to Calculating Household Assets: Understanding Your Financial Worth

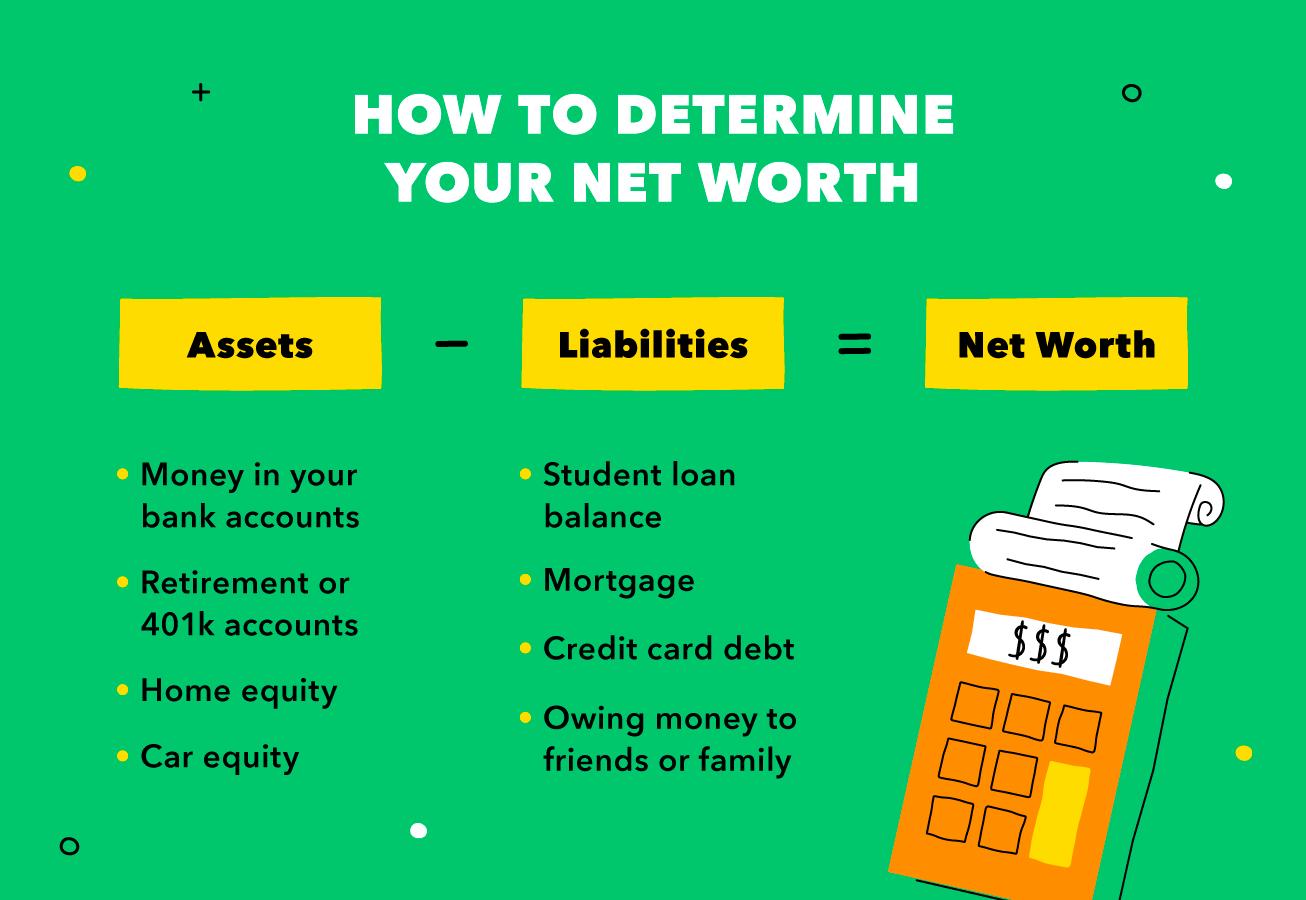

Determining the value of one’s household assets is a fundamental step in comprehending overall financial well-being. This process involves meticulously evaluating all tangible and intangible possessions, providing a clear picture of accumulated wealth and potential financial resources. Understanding the value of household assets offers numerous benefits, from informed financial planning to effective estate management. This comprehensive guide will delve into the intricacies of calculating household assets, offering practical tips and insights to empower individuals in making informed financial decisions.

Defining Household Assets: A Foundation for Evaluation

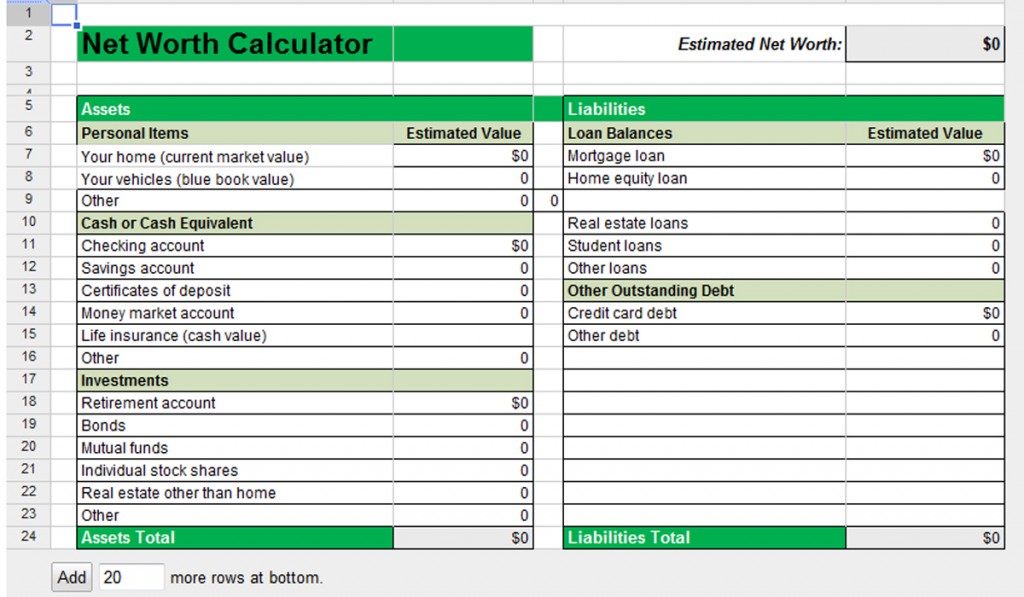

Household assets encompass all items of value owned by an individual or family within their residence. These can be broadly categorized into two primary groups:

1. Tangible Assets: These are physical possessions with inherent monetary value. Examples include:

- Real Estate: This comprises the primary residence, any additional properties owned, and land.

- Vehicles: Cars, trucks, motorcycles, and other motorized vehicles contribute significantly to asset value.

- Personal Property: This category includes furniture, appliances, electronics, jewelry, art, collectibles, and other valuables.

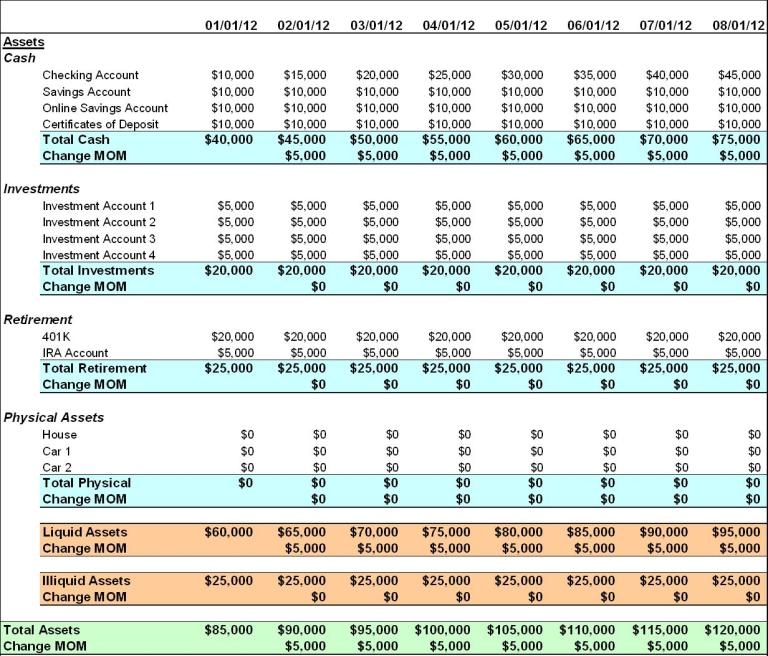

- Cash and Cash Equivalents: Savings accounts, checking accounts, money market accounts, and certificates of deposit represent readily accessible funds.

- Investments: Stocks, bonds, mutual funds, and other investment instruments represent potential growth and income.

2. Intangible Assets: These are non-physical assets with inherent value, often derived from intellectual property or legal rights. Examples include:

- Intellectual Property: Patents, copyrights, trademarks, and other forms of intellectual property can hold significant value.

- Business Interests: Ownership stakes in privately held or publicly traded companies represent valuable assets.

- Retirement Accounts: 401(k)s, IRAs, and other retirement savings plans hold accumulated wealth for future use.

- Life Insurance: The cash value of life insurance policies represents a source of potential funds.

The Importance of Accurate Asset Valuation: Unveiling Financial Clarity

Calculating the value of household assets is not merely a numerical exercise. It serves as a crucial foundation for informed financial decision-making, encompassing various aspects:

- Financial Planning: A comprehensive understanding of asset value allows for effective budgeting, savings strategies, and investment decisions.

- Debt Management: Knowing the value of assets provides a clearer picture of debt-to-asset ratios, facilitating informed decisions regarding debt reduction and refinancing.

- Insurance Coverage: Accurate asset valuation ensures appropriate insurance coverage, protecting against potential losses due to unforeseen events.

- Estate Planning: An accurate assessment of assets is essential for preparing wills, trusts, and other estate planning documents, ensuring the smooth transfer of wealth to beneficiaries.

- Tax Planning: Understanding the value of assets allows for effective tax planning strategies, minimizing tax liabilities and maximizing after-tax returns.

- Loan Applications: Banks and financial institutions often require detailed asset information during loan applications, facilitating access to credit and favorable loan terms.

Practical Steps to Calculate Household Asset Value: A Detailed Guide

Calculating the value of household assets requires a systematic approach, ensuring accuracy and comprehensiveness. Here’s a step-by-step guide:

1. Create a Detailed Inventory: Begin by creating a comprehensive list of all assets, including both tangible and intangible possessions.

- Real Estate: Obtain recent property appraisals or consult real estate professionals for accurate valuations.

- Vehicles: Consult online resources like Kelley Blue Book or Edmunds to determine current market values.

- Personal Property: Estimate the value of furniture, appliances, electronics, and other personal items based on purchase price, condition, and current market value. For valuable items like jewelry, art, or collectibles, consider obtaining professional appraisals.

- Cash and Cash Equivalents: Review bank statements and investment account balances to determine current balances.

- Investments: Obtain current market values for stocks, bonds, mutual funds, and other investment holdings.

- Intangible Assets: For intellectual property, business interests, and retirement accounts, consult with relevant professionals to determine accurate valuations.

2. Determine Market Value: Once you have a detailed inventory, determine the current market value of each asset. This may require research, consultations with experts, or using online tools.

- Real Estate: Current market value is typically determined by recent comparable sales in the area.

- Vehicles: Online tools provide estimates based on year, make, model, mileage, and condition.

- Personal Property: Estimate value based on purchase price, condition, and current market prices for similar items.

- Cash and Cash Equivalents: Current balances represent the market value.

- Investments: Market values for stocks, bonds, and other securities fluctuate daily, requiring regular updates.

- Intangible Assets: Valuing intangible assets can be complex, often requiring professional valuations.

3. Consider Depreciation and Appreciation: For tangible assets, factor in depreciation, which is the decline in value over time due to wear and tear or obsolescence. Conversely, some assets, like real estate or investments, may appreciate in value over time.

- Real Estate: Appreciation rates vary depending on location, market conditions, and property type.

- Vehicles: Cars depreciate rapidly in the first few years, with depreciation rates slowing down over time.

- Personal Property: Most personal items depreciate in value over time, with the rate depending on usage, condition, and market trends.

- Investments: Investments can appreciate or depreciate based on market performance and economic factors.

4. Document and Update Regularly: Maintain a comprehensive record of all asset valuations, including dates, sources, and supporting documentation. Regularly update valuations, especially for assets that are subject to significant fluctuations in market value.

5. Seek Professional Assistance: For complex assets like real estate, businesses, or intellectual property, consider consulting with professionals, such as real estate appraisers, business valuators, or financial advisors.

FAQs: Addressing Common Concerns about Calculating Household Assets

1. Is it necessary to calculate household asset value if I have no outstanding debts?

While debt-free individuals may not face immediate pressure to assess asset value, it remains crucial for informed financial planning. Understanding your financial resources allows for strategic savings, investment decisions, and future planning.

2. How often should I update my asset valuation?

The frequency of updates depends on the volatility of your assets. For assets like real estate, vehicles, and investments, annual updates are recommended. For cash and cash equivalents, regular monitoring is advisable to track fluctuations in balances.

3. What if I am unsure about the value of certain assets?

For items of uncertain value, consult online resources, seek professional appraisals, or compare prices for similar items in the market. It is better to err on the side of underestimation than overestimation.

4. How can I protect my assets from potential losses?

Adequate insurance coverage is crucial to protect against potential losses from events like fire, theft, or natural disasters. Ensure that your insurance policies reflect the current market value of your assets.

5. What is the role of asset valuation in estate planning?

Accurate asset valuation is essential for estate planning, as it provides a clear picture of your assets to beneficiaries. It facilitates the smooth transfer of wealth, minimizing potential disputes and tax liabilities.

Tips for Effective Asset Valuation: Maximizing Accuracy and Insight

- Utilize Online Resources: Explore online tools like Kelley Blue Book for vehicles, Zillow for real estate, and various investment platforms to obtain market valuations.

- Consult Professionals: For complex assets like real estate, businesses, or intellectual property, engage professionals for accurate valuations.

- Keep Detailed Records: Maintain a comprehensive inventory of all assets, including purchase dates, receipts, and supporting documentation.

- Regularly Update Valuations: Monitor asset values periodically, especially for volatile assets like investments or vehicles.

- Consider Depreciation and Appreciation: Factor in depreciation for tangible assets and potential appreciation for assets like real estate or investments.

- Seek Financial Advice: Consult with a financial advisor for personalized guidance on asset valuation and financial planning.

Conclusion: Empowering Financial Decisions Through Asset Valuation

Calculating the value of household assets is a fundamental aspect of informed financial decision-making. By meticulously evaluating all possessions, individuals gain a clear picture of their financial resources, facilitating strategic planning, debt management, insurance coverage, estate planning, and tax optimization. This comprehensive guide has provided practical steps, FAQs, and tips to empower individuals in understanding their financial worth and making informed decisions for a secure and prosperous future. Remember, a well-defined understanding of asset value is not merely a numerical exercise but a foundation for achieving financial well-being and securing a brighter financial future.

:max_bytes(150000):strip_icc()/household_income.aspfinal-dddb0f870b8e4195993e0a9fa2c2fa20.jpg)

Closure

Thus, we hope this article has provided valuable insights into A Comprehensive Guide to Calculating Household Assets: Understanding Your Financial Worth. We hope you find this article informative and beneficial. See you in our next article!