A Comprehensive Guide To Household Budget Categories

A Comprehensive Guide to Household Budget Categories

Related Articles: A Comprehensive Guide to Household Budget Categories

Introduction

With great pleasure, we will explore the intriguing topic related to A Comprehensive Guide to Household Budget Categories. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: A Comprehensive Guide to Household Budget Categories

- 2 Introduction

- 3 A Comprehensive Guide to Household Budget Categories

- 3.1 Essential Categories for Household Budget Items

- 3.2 FAQs by Categories for Household Budget Items

- 3.3 Conclusion by Categories for Household Budget Items

- 4 Closure

A Comprehensive Guide to Household Budget Categories

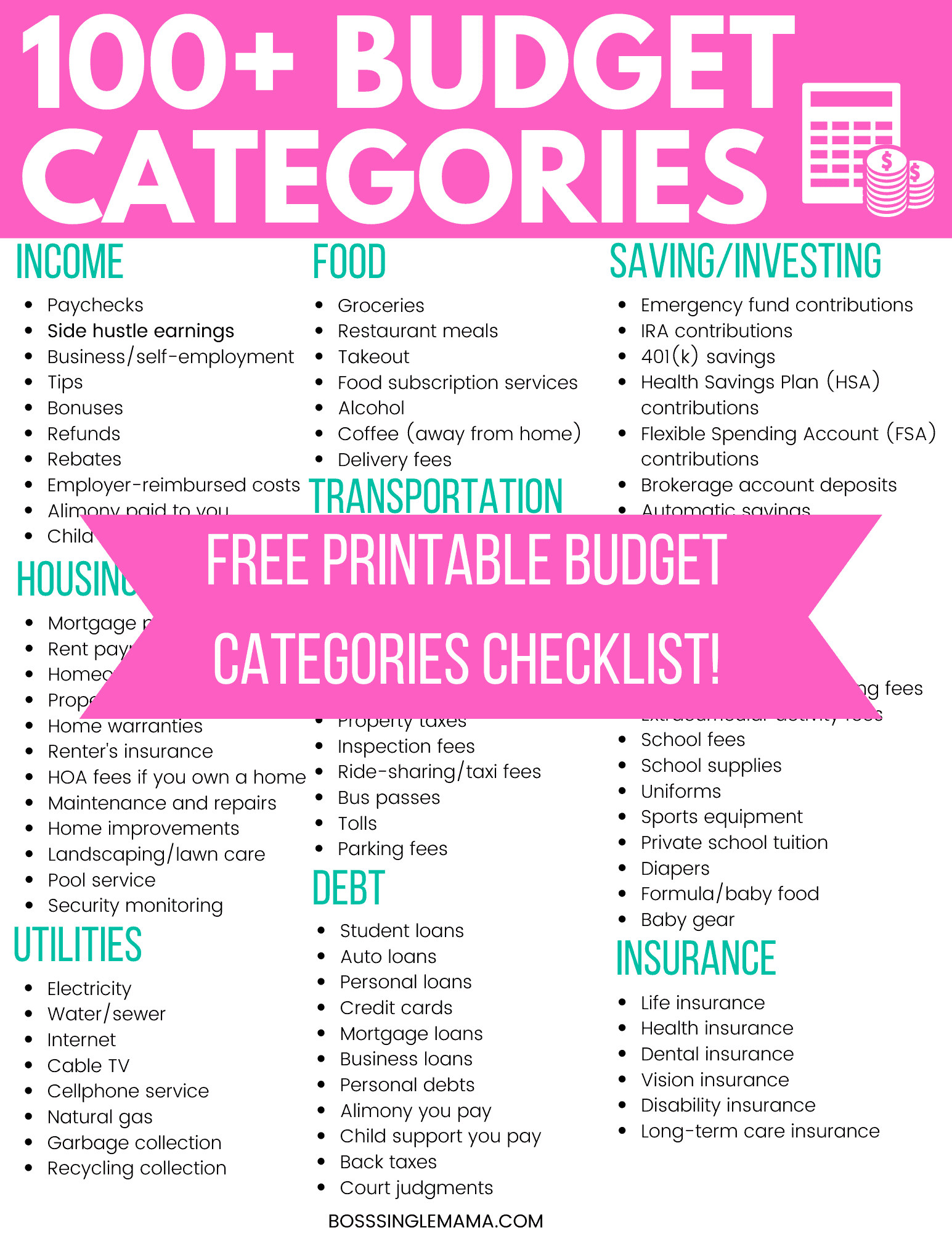

Creating a household budget is a crucial step towards financial stability and achieving financial goals. A well-structured budget provides a clear picture of income and expenses, allowing for informed financial decisions and efficient resource allocation. This comprehensive guide explores the essential categories for household budget items, providing insights into their importance and offering practical tips for effective budgeting.

Essential Categories for Household Budget Items

1. Housing: This category encompasses all costs associated with your living space, and is often the largest expense for most households. It includes:

- Mortgage or Rent: The primary cost of your housing, whether you own or rent.

- Property Taxes: Annual taxes levied on property ownership.

- Homeowners Insurance: Coverage for damage or loss to your property.

- Utilities: Essential services such as electricity, gas, water, and sewage.

- Home Maintenance: Regular upkeep and repairs, including landscaping, pest control, and appliance maintenance.

Importance: Housing is a fundamental need and a significant financial commitment. Effective budgeting in this category ensures stable and affordable living arrangements.

Tips:

- Negotiate: Explore rent negotiation possibilities or consider refinancing your mortgage for lower interest rates.

- Energy Efficiency: Implement energy-saving measures like LED lighting and programmable thermostats to reduce utility costs.

- Maintenance Plan: Set aside funds for regular maintenance to prevent costly repairs in the future.

2. Transportation: This category includes all expenses related to getting around, whether by car, public transport, or other means.

- Vehicle Payments: Loan repayments for car purchases.

- Fuel: Gasoline or other fuel costs.

- Insurance: Comprehensive and collision coverage for your vehicle.

- Public Transportation: Fares for buses, trains, or subways.

- Vehicle Maintenance: Regular servicing, repairs, and tire replacements.

Importance: Transportation is essential for work, education, and everyday life. A well-managed transportation budget ensures reliable and affordable mobility.

Tips:

- Carpooling or Public Transport: Utilize alternative transportation options to minimize fuel and vehicle maintenance costs.

- Vehicle Maintenance Schedule: Adhere to recommended service intervals to prevent costly breakdowns and extend vehicle lifespan.

- Compare Insurance Rates: Regularly compare quotes from different insurance providers to secure the best rates.

3. Food: This category encompasses all expenses related to feeding yourself and your family.

- Groceries: Food purchases from supermarkets or grocery stores.

- Dining Out: Restaurant meals, takeout, or food delivery services.

- Snacks and Beverages: Non-essential food items and drinks.

Importance: Food is a basic necessity for survival and well-being. A well-planned food budget ensures healthy and affordable meals.

Tips:

- Meal Planning: Create weekly meal plans to minimize impulsive grocery purchases and food waste.

- Cook at Home: Prepare meals at home more often to save money compared to dining out.

- Shop Smart: Utilize coupons, compare prices, and buy in bulk for frequently consumed items.

4. Healthcare: This category covers all medical expenses, including insurance premiums, doctor visits, and prescription medications.

- Health Insurance: Premiums for health coverage, including deductibles and co-pays.

- Doctor Visits: Fees for consultations, check-ups, and specialist appointments.

- Prescription Medications: Costs for prescribed drugs and over-the-counter medications.

- Dental Care: Costs for dental check-ups, cleanings, and procedures.

- Vision Care: Expenses for eye exams, glasses, and contact lenses.

Importance: Healthcare is crucial for maintaining physical and mental well-being. A comprehensive healthcare budget ensures access to necessary medical care.

Tips:

- Preventive Care: Regular check-ups and screenings can detect health issues early and potentially reduce future healthcare costs.

- Generic Medications: Consider generic alternatives to brand-name medications to save money.

- Negotiate Medical Bills: Contact healthcare providers and insurance companies to negotiate lower payment options.

5. Personal Care: This category encompasses expenses related to personal hygiene, grooming, and beauty.

- Toiletries: Shampoo, soap, toothpaste, and other hygiene products.

- Haircuts and Salons: Hairdressing services, styling, and salon treatments.

- Clothing and Accessories: Purchases of new clothes, shoes, and accessories.

Importance: Personal care is essential for maintaining a healthy appearance and self-esteem. A well-balanced personal care budget allows for both necessary and discretionary spending.

Tips:

- Buy in Bulk: Purchase toiletries and hygiene products in larger quantities to save money.

- DIY Beauty: Explore affordable DIY beauty routines using natural ingredients.

- Shop Sales: Take advantage of sales and discounts on clothing and accessories.

6. Entertainment: This category includes expenses related to leisure activities, hobbies, and entertainment.

- Movies and Shows: Tickets for movies, concerts, and live events.

- Streaming Services: Subscriptions for online streaming platforms.

- Books and Magazines: Purchases of books, magazines, and other reading materials.

- Hobbies and Sports: Costs associated with hobbies, sports, and recreational activities.

Importance: Entertainment provides relaxation, enjoyment, and social interaction. A balanced entertainment budget ensures access to enjoyable activities without overspending.

Tips:

- Free Activities: Explore free or low-cost entertainment options, such as parks, libraries, and community events.

- Shared Subscriptions: Share streaming services with friends or family members to reduce individual costs.

- Set Entertainment Limits: Establish a monthly entertainment budget and stick to it.

7. Education: This category covers expenses related to learning and personal development.

- Tuition: Fees for college, university, or other educational programs.

- Books and Supplies: Costs for textbooks, notebooks, and other learning materials.

- Online Courses: Fees for online learning platforms and educational programs.

- Professional Development: Expenses for workshops, conferences, and training programs.

Importance: Education is crucial for personal growth, career advancement, and lifelong learning. A well-managed education budget allows for investments in knowledge and skills.

Tips:

- Scholarships and Grants: Explore financial aid options to reduce the cost of education.

- Free Online Resources: Utilize free online learning platforms and resources to supplement formal education.

- Prioritize Learning: Focus on educational investments that align with career goals and personal interests.

8. Childcare: This category includes expenses related to the care and supervision of children.

- Daycare: Fees for daycare centers or in-home caregivers.

- Babysitting: Costs for occasional babysitting services.

- Child-Related Activities: Fees for extracurricular activities, sports, and lessons.

Importance: Childcare is essential for working parents or those who require assistance with child supervision. A well-planned childcare budget ensures access to reliable and affordable care.

Tips:

- Explore Options: Research different childcare options and compare costs and services.

- Tax Credits: Investigate potential tax credits or deductions available for childcare expenses.

- Family Support: Utilize family or friends for occasional childcare assistance to reduce costs.

9. Gifts: This category covers expenses related to gifts for birthdays, holidays, and other special occasions.

- Gifts for Family and Friends: Purchases of gifts for loved ones.

- Charity Donations: Contributions to charitable organizations.

Importance: Gifts are a way to express affection, celebrate special occasions, and support worthy causes. A thoughtful gift budget ensures responsible spending without overextending finances.

Tips:

- Gift Registry: Encourage friends and family to utilize gift registries for specific events.

- Homemade Gifts: Consider creating personalized or handmade gifts to reduce costs.

- Set Spending Limits: Establish a budget for gift-giving and stick to it.

10. Savings: This category is not an expense but a crucial element of a healthy financial plan.

- Emergency Fund: A reserve of funds for unexpected expenses or financial emergencies.

- Retirement Savings: Contributions to retirement accounts for future financial security.

- Other Savings Goals: Dedicated funds for specific goals, such as down payments, travel, or education.

Importance: Savings provide financial security, peace of mind, and the ability to pursue future goals. A well-structured savings plan ensures financial stability and preparedness for unexpected events.

Tips:

- Automate Savings: Set up automatic transfers to savings accounts to ensure regular contributions.

- Review Savings Goals: Regularly assess and adjust savings goals based on changing priorities and financial circumstances.

- Seek Professional Advice: Consult with a financial advisor to develop a personalized savings plan.

11. Debt Payments: This category encompasses all payments related to outstanding loans and credit card debt.

- Mortgage or Rent: Monthly payments for home loans or rent.

- Student Loans: Repayments for educational loans.

- Car Loans: Monthly payments for vehicle financing.

- Credit Card Debt: Minimum payments or balances owed on credit cards.

- Other Loans: Repayments for personal loans or other outstanding debts.

Importance: Managing debt is crucial for financial stability and building a strong credit score. A well-planned debt repayment strategy ensures responsible borrowing and minimizes interest charges.

Tips:

- Debt Consolidation: Consider consolidating multiple debts into a single loan with a lower interest rate.

- Snowball Method: Focus on paying off smaller debts first to gain momentum and motivation.

- Budget for Debt Repayment: Allocate a specific portion of your budget for debt repayment.

12. Miscellaneous: This category encompasses all remaining expenses that do not fit into other categories.

- Subscriptions: Fees for services like streaming platforms, gym memberships, or software subscriptions.

- Personal Expenses: Costs for personal items, hobbies, or discretionary spending.

- Travel: Expenses related to vacations, business trips, or travel within the local area.

- Gifts: Purchases of gifts for birthdays, holidays, or other special occasions.

- Charity Donations: Contributions to charitable organizations.

Importance: The Miscellaneous category allows for flexibility and accounting for unforeseen expenses or discretionary spending.

Tips:

- Track Spending: Carefully monitor miscellaneous expenses to identify areas for potential savings.

- Review Subscriptions: Regularly assess subscriptions and cancel any services that are no longer needed.

- Set Spending Limits: Establish a budget for miscellaneous expenses and adhere to it.

FAQs by Categories for Household Budget Items

Housing:

-

Q: What is the best way to determine a reasonable housing budget?

-

A: Aim to spend no more than 30% of your gross monthly income on housing expenses. This includes mortgage or rent, property taxes, homeowners insurance, and utilities.

-

Q: How can I reduce my utility costs?

-

A: Implement energy-saving measures like LED lighting, programmable thermostats, and energy-efficient appliances.

Transportation:

-

Q: Is it always cheaper to own a car than to use public transportation?

-

A: The cost of car ownership can vary significantly depending on factors like vehicle type, maintenance costs, and fuel prices. Public transportation can be a more affordable option in some areas.

-

Q: How can I save money on car insurance?

-

A: Shop around for quotes from different insurance providers, consider increasing your deductible, and maintain a good driving record.

Food:

-

Q: What are some effective strategies for reducing grocery bills?

-

A: Meal planning, utilizing coupons and discounts, shopping in bulk for frequently consumed items, and avoiding impulse purchases can all help reduce grocery costs.

-

Q: How can I limit dining out expenses?

-

A: Prepare meals at home more often, explore affordable takeout options, and set a budget for dining out.

Healthcare:

-

Q: What are the best ways to lower healthcare costs?

-

A: Consider generic medications, negotiate medical bills, and prioritize preventive care to avoid costly health issues in the future.

-

Q: How can I find affordable health insurance?

-

A: Explore different insurance plans, compare coverage and costs, and consider enrolling in a health savings account (HSA).

Personal Care:

-

Q: What are some budget-friendly alternatives to expensive salon treatments?

-

A: Explore DIY beauty routines using natural ingredients, purchase toiletries in bulk, and take advantage of sales and discounts on personal care products.

-

Q: How can I save money on clothing?

-

A: Shop for clothes during sales and clearance events, consider secondhand clothing options, and focus on purchasing quality items that will last longer.

Entertainment:

-

Q: How can I enjoy entertainment without breaking the bank?

-

A: Utilize free or low-cost entertainment options, share streaming services with friends or family, and set a monthly entertainment budget.

-

Q: What are some budget-friendly hobbies?

-

A: Explore hobbies like reading, hiking, cooking, or volunteering, which offer enjoyment without significant financial investment.

Education:

-

Q: What are some affordable ways to continue learning?

-

A: Utilize free online learning platforms, explore scholarships and grants, and prioritize educational investments that align with career goals.

-

Q: How can I reduce the cost of college tuition?

-

A: Consider community college or online programs, apply for financial aid, and explore work-study opportunities.

Childcare:

-

Q: What are some affordable childcare options?

-

A: Research daycare centers, consider in-home caregivers, and explore family or friend support for occasional childcare assistance.

-

Q: How can I save money on childcare expenses?

-

A: Utilize tax credits or deductions available for childcare expenses, explore flexible work arrangements, and consider alternative childcare options like shared childcare or nanny-sharing.

Gifts:

-

Q: How can I make thoughtful gifts without spending a lot of money?

-

A: Consider homemade gifts, utilize gift registries, and set spending limits for gift-giving.

-

Q: What are some budget-friendly charity donation options?

-

A: Explore local charities, donate gently used items, and consider volunteering your time instead of monetary contributions.

Savings:

-

Q: How much should I save for an emergency fund?

-

A: Aim to save at least 3-6 months of living expenses in an emergency fund.

-

Q: How can I start saving for retirement?

-

A: Contribute to a 401(k) or IRA, take advantage of employer matching programs, and invest in a diversified portfolio.

Debt Payments:

-

Q: How can I get out of debt faster?

-

A: Consider debt consolidation, utilize the snowball method, and allocate a significant portion of your budget to debt repayment.

-

Q: How can I avoid accumulating more debt?

-

A: Create a realistic budget, track spending, prioritize needs over wants, and avoid using credit cards for unnecessary purchases.

Miscellaneous:

-

Q: How can I manage miscellaneous expenses effectively?

-

A: Track spending, review subscriptions, and set spending limits for miscellaneous items.

-

Q: What are some tips for budgeting for travel?

-

A: Plan ahead, travel during off-season, consider alternative transportation options, and explore budget-friendly accommodation choices.

Conclusion by Categories for Household Budget Items

Creating a comprehensive household budget is essential for financial stability, responsible spending, and achieving financial goals. By diligently categorizing expenses, tracking spending, and implementing effective budgeting strategies, individuals can gain control over their finances and build a solid foundation for a secure future. Regularly reviewing and adjusting budget categories to reflect changing circumstances and priorities is crucial for maintaining a healthy financial plan and achieving financial success.

Closure

Thus, we hope this article has provided valuable insights into A Comprehensive Guide to Household Budget Categories. We appreciate your attention to our article. See you in our next article!