Navigating Household Purchases With Less-Than-Perfect Credit

Navigating Household Purchases with Less-Than-Perfect Credit

Related Articles: Navigating Household Purchases with Less-Than-Perfect Credit

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Household Purchases with Less-Than-Perfect Credit. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Household Purchases with Less-Than-Perfect Credit

Acquiring essential household items can be a significant financial undertaking, particularly for individuals with less-than-perfect credit scores. While traditional financing options might seem restrictive, there are alternative paths to furnish a comfortable and functional home without compromising financial stability. This article delves into strategies for purchasing household items when credit history presents challenges, exploring various financing avenues, and offering practical tips for navigating the process.

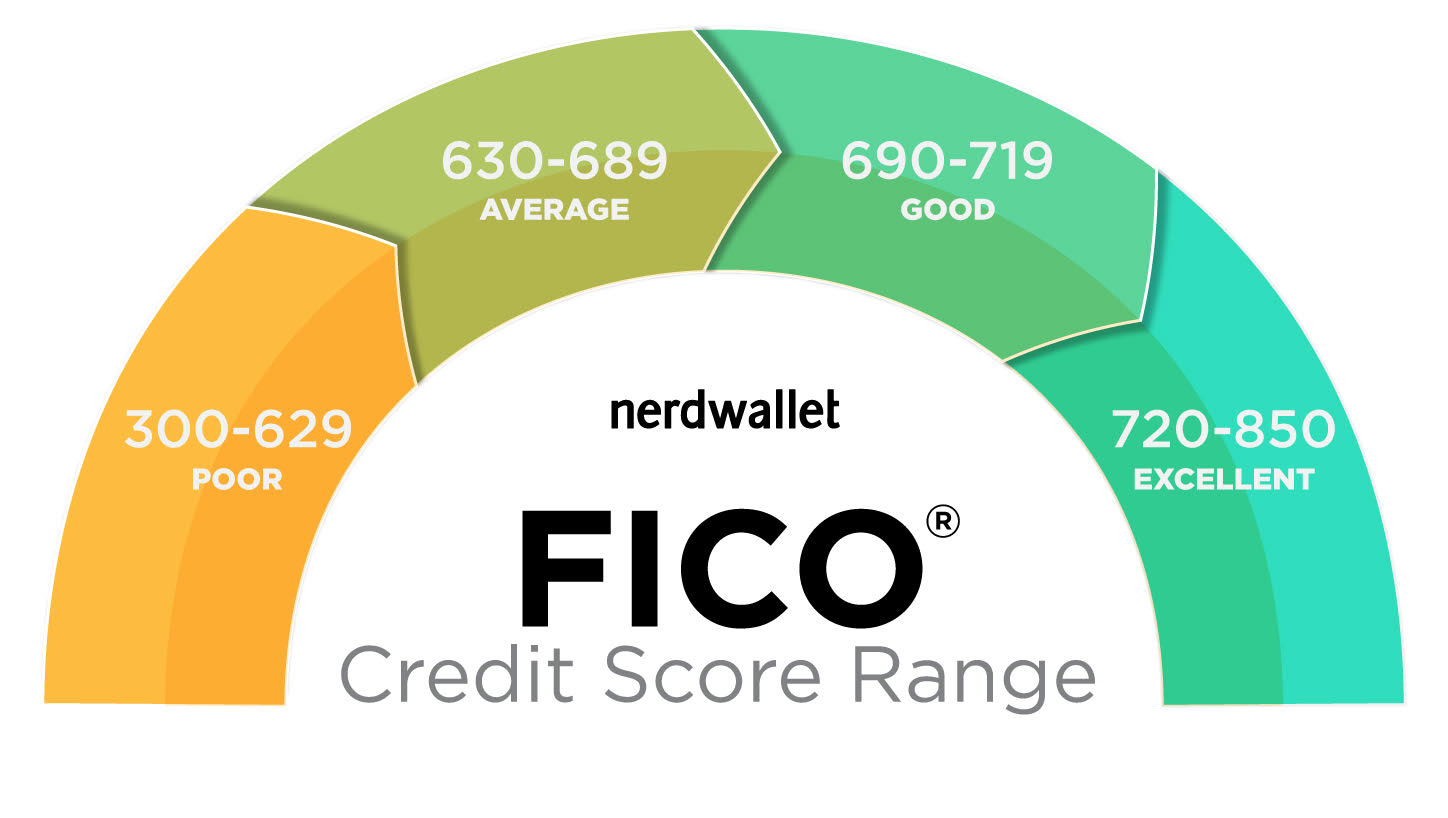

Understanding the Challenges of Bad Credit

A lower credit score can significantly impact access to traditional financing options. Lenders often view individuals with bad credit as higher-risk borrowers, resulting in:

- Higher Interest Rates: Lenders compensate for perceived risk by charging higher interest rates on loans. This can make repayments more expensive and potentially unsustainable.

- Limited Loan Amounts: Credit limitations might restrict the amount of money available for purchases, potentially hindering the acquisition of necessary household items.

- Stricter Eligibility Requirements: Lenders may impose stricter eligibility criteria, including minimum credit scores, income levels, and debt-to-income ratios, making it difficult to qualify for loans.

Alternative Financing Options for Household Purchases

Despite these hurdles, individuals with less-than-perfect credit can still access financing for household items through alternative avenues:

1. Rent-to-Own Programs:

Rent-to-own programs offer a unique approach to purchasing essential items, allowing individuals to rent an item while making regular payments. After a specified period, the renter has the option to purchase the item at a predetermined price. These programs can be beneficial for individuals who:

- Need immediate access to essential items: Rent-to-own programs provide immediate access to items like appliances, furniture, and electronics, crucial for establishing a comfortable home.

- Have limited credit history: Rent-to-own programs often have less stringent credit requirements, making them accessible to individuals with limited or damaged credit.

- Prefer predictable monthly payments: Rent-to-own programs typically involve fixed monthly payments, offering budgeting stability and transparency.

2. Lease-to-Own Programs:

Similar to rent-to-own, lease-to-own programs allow individuals to lease an item with the option to purchase it at the end of the lease term. Key differences include:

- Ownership transfer: Lease-to-own programs typically involve a formal lease agreement, legally transferring ownership to the lessee upon completion of lease payments.

- Flexibility: Lease-to-own programs often offer more flexible terms, such as early purchase options or the ability to return the item if needed.

3. Peer-to-Peer Lending Platforms:

Peer-to-peer (P2P) lending platforms connect borrowers with individual investors, bypassing traditional financial institutions. This alternative financing model can offer:

- Potentially lower interest rates: P2P platforms often have lower interest rates compared to traditional loans, as they rely on individual investor risk assessments.

- Greater flexibility: P2P platforms may offer more flexible loan terms and eligibility requirements, potentially accommodating individuals with less-than-perfect credit.

- Faster approval process: P2P lending platforms typically have faster approval processes compared to traditional lenders, allowing for quicker access to funds.

4. Store Financing Programs:

Many retailers offer their own financing programs, tailored to specific customer needs. These programs often:

- Offer lower interest rates: Store financing programs can offer lower interest rates compared to traditional credit cards, making them more affordable for certain purchases.

- Provide flexible repayment terms: Retailers often provide flexible repayment terms, including extended payment periods or the option to defer payments for a specific period.

- Focus on specific product categories: Store financing programs typically focus on specific product categories, such as appliances, furniture, or electronics, offering targeted financing solutions.

5. Credit Unions and Community Banks:

Credit unions and community banks often have more lenient lending practices compared to larger financial institutions. These institutions may:

- Offer personalized loan programs: Credit unions and community banks often offer personalized loan programs tailored to individual needs and credit histories.

- Prioritize community relationships: These institutions prioritize building relationships with their members and customers, potentially offering more flexibility and understanding for individuals with less-than-perfect credit.

- Provide financial counseling: Credit unions and community banks often provide financial counseling services, offering guidance on managing finances and improving credit scores.

6. Secured Loans:

Secured loans require collateral, such as a vehicle or a savings account, to secure the loan. This collateral mitigates risk for lenders, potentially resulting in:

- Lower interest rates: Secured loans often have lower interest rates compared to unsecured loans, as the collateral provides a safety net for lenders.

- Higher loan amounts: Secured loans typically allow for larger loan amounts, providing greater financial flexibility for significant household purchases.

7. Personal Loans:

Personal loans can be used for various purposes, including household item purchases. While interest rates can vary depending on creditworthiness, personal loans offer:

- Flexible repayment terms: Personal loans often provide flexible repayment terms, allowing individuals to choose a repayment period that suits their financial circumstances.

- Consolidation of debt: Personal loans can be used to consolidate existing debt, potentially lowering interest rates and simplifying repayment.

Tips for Navigating Household Purchases with Bad Credit:

- Improve your credit score: Focus on improving your credit score before applying for financing. This can involve paying bills on time, reducing credit card balances, and avoiding new credit applications.

- Shop around for the best rates: Compare interest rates and terms from different lenders before making a decision.

- Consider a smaller purchase: If financing is a challenge, consider purchasing smaller items gradually over time.

- Negotiate with sellers: Inquire about potential discounts or financing options offered by retailers.

- Seek professional financial guidance: Consult a financial advisor for personalized guidance on managing finances and navigating credit challenges.

Frequently Asked Questions (FAQs):

1. How can I improve my credit score before purchasing household items?

- Pay bills on time: Timely payments demonstrate responsible financial management.

- Reduce credit card balances: Lowering credit card balances improves your credit utilization ratio, a key factor in credit scoring.

- Avoid new credit applications: Each credit application creates a hard inquiry, negatively impacting your score.

- Check your credit report for errors: Dispute any inaccuracies on your credit report to ensure a fair score.

2. What are the risks associated with rent-to-own or lease-to-own programs?

- Higher overall cost: Rent-to-own and lease-to-own programs often involve higher overall costs compared to traditional purchases, due to interest charges and potential markup on the final purchase price.

- Limited flexibility: These programs can be less flexible than traditional financing options, potentially restricting the ability to return the item or change payment terms.

3. What are the best ways to find a reputable peer-to-peer lending platform?

- Research online reviews: Read reviews from other borrowers to assess the platform’s reputation and customer satisfaction.

- Check for regulatory compliance: Ensure the platform is licensed and regulated by relevant authorities.

- Consider loan terms and fees: Compare interest rates, origination fees, and other charges before choosing a platform.

4. How can I find store financing programs that suit my needs?

- Visit retailer websites: Many retailers advertise their financing programs on their websites.

- Inquire with store representatives: Ask store representatives about available financing options and eligibility criteria.

- Compare interest rates and terms: Compare financing terms from different retailers to find the most favorable option.

5. What are the advantages of using credit unions or community banks for financing?

- Personalized loan programs: These institutions often offer customized loan programs tailored to individual needs and credit histories.

- Community focus: Credit unions and community banks prioritize building relationships with members and customers, potentially offering more flexibility and understanding.

- Financial counseling: These institutions often provide financial counseling services, offering guidance on managing finances and improving credit scores.

Conclusion:

Navigating household purchases with less-than-perfect credit requires careful planning and a proactive approach. By exploring alternative financing options, understanding the associated risks, and utilizing available resources, individuals can acquire essential items without compromising their financial stability. Improving credit scores through responsible financial practices and seeking professional guidance when needed can further enhance access to favorable financing options, ultimately paving the way for a comfortable and functional home.

Closure

Thus, we hope this article has provided valuable insights into Navigating Household Purchases with Less-Than-Perfect Credit. We appreciate your attention to our article. See you in our next article!