Navigating The Complexities Of Real Estate Transactions During Probate

Navigating the Complexities of Real Estate Transactions During Probate

Related Articles: Navigating the Complexities of Real Estate Transactions During Probate

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Complexities of Real Estate Transactions During Probate. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Complexities of Real Estate Transactions During Probate

Probate, the legal process of administering a deceased person’s estate, often involves the transfer of real estate. The question of whether a house can be sold during probate arises frequently, and understanding the intricacies of this process is crucial for both beneficiaries and the executor of the estate.

The Legal Framework

Probate law dictates that the executor, appointed by the deceased’s will or by the court if no will exists, is responsible for managing the estate’s assets, including real property. This includes the power to sell assets, such as a house, to settle debts and distribute the remaining assets to the beneficiaries.

The Process of Selling a House During Probate

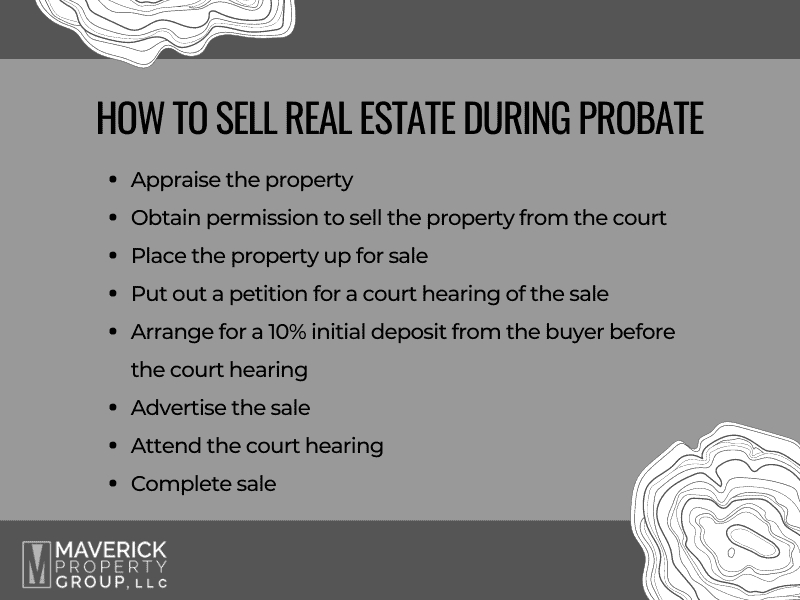

Selling a house during probate requires adherence to specific legal procedures. The executor must:

-

Obtain Court Approval: In most jurisdictions, the executor needs court authorization to sell real estate belonging to the estate. This typically involves filing a petition with the probate court, outlining the reasons for the sale and the proposed terms.

-

Market and Sell the Property: Once court approval is granted, the executor can proceed with marketing and selling the house. This process is similar to any other real estate transaction, involving listing the property, showing it to potential buyers, and negotiating a sale price.

-

Closing the Sale: The closing process involves the transfer of ownership from the estate to the buyer. The executor will sign the necessary documents, and the proceeds from the sale will be deposited into the estate’s account.

Considerations for Selling During Probate

Several factors influence the feasibility and desirability of selling a house during probate:

- The Estate’s Financial Situation: If the estate is burdened by debt, selling the house might be necessary to settle these obligations.

- The Beneficiaries’ Wishes: Beneficiaries may have differing opinions on selling the house. Some may prefer to inherit it, while others may favor a quick sale to distribute the proceeds.

- Market Conditions: The real estate market’s current state can impact the sale price and the time it takes to find a buyer.

- The Condition of the Property: A house requiring significant repairs or updates may be more challenging to sell.

Potential Benefits of Selling During Probate

Selling a house during probate can offer several advantages:

- Debt Settlement: The proceeds from the sale can be used to settle debts owed by the deceased, preventing potential financial hardship for the estate and beneficiaries.

- Distribution of Assets: The sale allows for the distribution of assets to beneficiaries in a timely manner, minimizing delays and potential conflicts.

- Financial Liquidity: Selling the house provides the estate with cash, enabling the executor to manage other financial obligations efficiently.

Potential Challenges of Selling During Probate

Selling a house during probate can also present challenges:

- Legal Complexity: Probate proceedings are complex and require legal expertise. Navigating the process can be time-consuming and potentially costly.

- Time Constraints: Probate can be a lengthy process, impacting the timeline for selling the house.

- Emotional Considerations: The sale of a house that was once a home can be emotionally challenging for beneficiaries.

Frequently Asked Questions (FAQs)

Q: Can a house be sold without probate?

A: In some cases, a house can be sold without going through probate. For example, if the deceased owned the property jointly with another person with rights of survivorship, the surviving owner automatically inherits the property.

Q: How long does it take to sell a house during probate?

A: The time required to sell a house during probate varies depending on factors such as the complexity of the estate, the condition of the property, and market conditions. It can range from a few months to several years.

Q: Who is responsible for paying real estate taxes and maintenance costs during probate?

A: The executor is responsible for paying real estate taxes and maintenance costs during probate. These expenses are typically paid from the estate’s assets.

Q: Can beneficiaries object to the sale of a house during probate?

A: Beneficiaries may have the right to object to the sale of a house during probate. However, the court will ultimately decide whether the sale is in the best interests of the estate.

Tips for Selling a House During Probate

- Seek Legal Advice: Consult with an experienced probate attorney to understand the legal requirements and procedures for selling a house during probate.

- Obtain Court Approval: Ensure all necessary court approvals are obtained before proceeding with the sale.

- Market the Property Strategically: Engage a reputable real estate agent to market the property effectively and attract potential buyers.

- Be Transparent with Buyers: Disclose all relevant information about the property’s history and the probate process to potential buyers.

- Communicate with Beneficiaries: Keep beneficiaries informed throughout the process and address any concerns they may have.

Conclusion

Selling a house during probate is a complex process that requires careful planning and legal expertise. While it can be challenging, understanding the legal framework, navigating the procedures, and considering the various factors involved can lead to a successful outcome. By seeking professional guidance and adhering to the relevant regulations, executors and beneficiaries can ensure that the sale of the house is handled efficiently and fairly, ultimately contributing to the smooth administration of the deceased’s estate.

.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Complexities of Real Estate Transactions During Probate. We appreciate your attention to our article. See you in our next article!