Navigating The Path To Homeownership With Less-Than-Perfect Credit

Navigating the Path to Homeownership with Less-Than-Perfect Credit

Related Articles: Navigating the Path to Homeownership with Less-Than-Perfect Credit

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Path to Homeownership with Less-Than-Perfect Credit. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Path to Homeownership with Less-Than-Perfect Credit

Owning a home is often considered the cornerstone of the American dream, but the path to achieving this goal can be challenging, especially for individuals with less-than-perfect credit. While a strong credit score is traditionally seen as a prerequisite for securing a mortgage, it is not an insurmountable barrier. With careful planning, determination, and a strategic approach, individuals with lower credit scores can still achieve their homeownership aspirations.

This article aims to provide a comprehensive guide for individuals seeking to navigate the complexities of buying a home with less-than-perfect credit. It will explore various options, strategies, and resources available to help individuals overcome credit-related hurdles and achieve their dream of owning a home.

Understanding the Impact of Credit Score on Homeownership

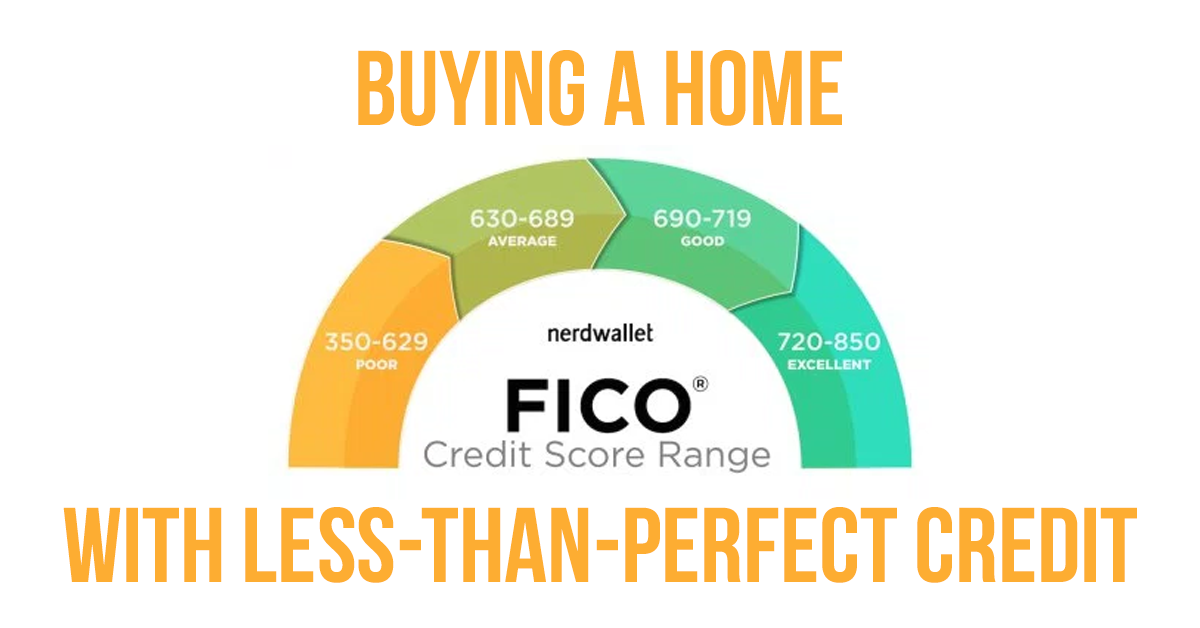

A credit score is a numerical representation of an individual’s creditworthiness, reflecting their ability to manage debt responsibly. Lenders use credit scores to assess the risk associated with lending money to borrowers. A higher credit score generally indicates a lower risk, leading to more favorable loan terms, such as lower interest rates and more lenient loan requirements. Conversely, a lower credit score signifies a higher risk, potentially resulting in higher interest rates, stricter loan terms, or even loan denial.

For those with less-than-perfect credit, navigating the mortgage landscape can feel daunting. Lower credit scores often translate to limited loan options, higher interest rates, and more stringent loan requirements. This can significantly impact the affordability of homeownership, requiring larger down payments, higher monthly payments, or even limiting the types of homes that can be considered.

Strategies for Overcoming Credit Challenges

Despite the challenges, individuals with less-than-perfect credit can still pursue homeownership. The key lies in understanding the available options and developing a strategic approach.

1. Building and Improving Credit:

- Monitor Credit Reports: Regularly reviewing credit reports for errors or inaccuracies is crucial. Disputed items can negatively impact credit scores, and correcting these errors can lead to improvements.

- Pay Bills on Time: Consistent on-time payments are the cornerstone of building a strong credit history. Automating bill payments and setting reminders can help ensure timely payments.

- Reduce Debt: Lowering existing debt burdens can significantly improve credit scores. Prioritize high-interest debt and explore strategies like debt consolidation or balance transfers.

- Use Credit Wisely: Responsible credit card usage can help build credit. Maintaining low balances and paying balances in full each month can positively impact credit scores.

2. Exploring Loan Options:

- FHA Loans: The Federal Housing Administration (FHA) offers government-insured loans with more lenient credit score requirements than conventional loans. FHA loans can be an excellent option for individuals with lower credit scores, but they typically come with mortgage insurance premiums.

- VA Loans: Veterans Affairs (VA) loans are available to eligible veterans, active-duty military personnel, and surviving spouses. These loans offer competitive interest rates and no down payment requirement, making them attractive options for those with less-than-perfect credit.

- USDA Loans: The United States Department of Agriculture (USDA) provides loans for rural properties. These loans offer low interest rates and flexible credit requirements, making them an attractive option for individuals with lower credit scores.

- Private Loans: Some private lenders specialize in offering loans to borrowers with less-than-perfect credit. These loans may come with higher interest rates but can provide access to financing when traditional options are unavailable.

3. Strengthening the Application:

- Large Down Payment: A substantial down payment can offset the risk associated with a lower credit score. A larger down payment may lead to more favorable loan terms and potentially lower interest rates.

- Stable Income: Demonstrating a consistent income history and a stable job can enhance the attractiveness of a loan application.

- Debt-to-Income Ratio: Keeping the debt-to-income ratio (DTI) low is crucial for loan approval. DTI represents the percentage of monthly income dedicated to debt payments. Lowering DTI can improve loan eligibility.

- Co-Signer: Involving a co-signer with good credit can significantly improve loan approval chances. The co-signer assumes joint responsibility for the loan, providing lenders with greater assurance.

4. Seeking Professional Guidance:

- Credit Counseling: Credit counseling agencies can provide guidance on improving credit scores, managing debt, and developing a financial plan.

- Mortgage Broker: A mortgage broker can assist in navigating the complex mortgage landscape, comparing loan options from various lenders, and securing the most favorable terms.

Benefits of Homeownership with Less-Than-Perfect Credit

While the path to homeownership may be more challenging for those with less-than-perfect credit, the rewards are significant.

- Building Equity: Owning a home allows individuals to build equity over time. As property values appreciate and mortgage payments are made, equity accumulates, creating a valuable asset.

- Tax Advantages: Homeowners can benefit from tax deductions related to mortgage interest and property taxes, potentially reducing their overall tax liability.

- Stability and Security: Owning a home provides a sense of stability and security, offering a place to call home and a foundation for future financial goals.

- Pride of Ownership: Homeownership brings a sense of pride and accomplishment, contributing to a sense of belonging and community involvement.

FAQs

Q: What credit score is required to buy a house?

A: While there is no universal credit score requirement, most lenders prefer a credit score of 620 or higher for conventional loans. However, alternative loan programs like FHA, VA, and USDA loans may have lower credit score requirements.

Q: Can I buy a house with a credit score below 620?

A: Yes, it is possible to buy a house with a credit score below 620. However, loan options may be limited, and interest rates may be higher. Exploring alternative loan programs like FHA, VA, or USDA loans can be beneficial.

Q: How long does it take to improve my credit score?

A: Improving credit scores takes time and consistent effort. It typically takes 6-12 months to see significant improvements. However, even small improvements can make a difference in qualifying for a mortgage.

Q: How can I find a lender willing to work with me?

A: Mortgage brokers can assist in finding lenders willing to work with borrowers with less-than-perfect credit. They can compare loan options from various lenders and identify the most suitable options.

Q: What are the risks of buying a house with less-than-perfect credit?

A: Buying a house with less-than-perfect credit can lead to higher interest rates, stricter loan terms, and potentially higher closing costs. It is crucial to carefully consider the financial implications and ensure the purchase fits within your budget.

Tips for Success

- Start Early: Begin improving your credit score as early as possible to maximize your chances of securing a mortgage.

- Get Pre-Approved: Obtaining pre-approval from a lender can demonstrate financial readiness and streamline the home buying process.

- Shop Around: Compare loan options from multiple lenders to find the most favorable terms and interest rates.

- Be Realistic: Set realistic expectations about the types of homes you can afford based on your credit score and financial situation.

- Seek Professional Guidance: Don’t hesitate to seek guidance from credit counselors, mortgage brokers, or financial advisors to navigate the complexities of homeownership with less-than-perfect credit.

Conclusion

Buying a house with less-than-perfect credit can be a challenging but achievable goal. By understanding the impact of credit scores, exploring available options, and developing a strategic approach, individuals can overcome credit-related hurdles and realize their dream of homeownership. Remember, building a strong credit history is an ongoing process. By consistently making responsible financial decisions, individuals can improve their creditworthiness and unlock the path to a brighter financial future.

![Your Journey to Homeownership [INFOGRAPHIC] - Christine Pervan Mid America Mortgage, Inc.](http://mtg-lady.com/wp-content/uploads/2021/11/20211119-MEM.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Path to Homeownership with Less-Than-Perfect Credit. We thank you for taking the time to read this article. See you in our next article!