Navigating The Path To Homeownership With Less-Than-Perfect Credit

Navigating the Path to Homeownership with Less-Than-Perfect Credit

Related Articles: Navigating the Path to Homeownership with Less-Than-Perfect Credit

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Path to Homeownership with Less-Than-Perfect Credit. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Path to Homeownership with Less-Than-Perfect Credit

The dream of homeownership is a powerful motivator for many, but achieving it can seem daunting, especially when faced with less-than-ideal credit history. While a strong credit score often acts as a gateway to favorable loan terms, it is not an insurmountable barrier. There are numerous strategies and resources available for individuals with less-than-perfect credit to pursue their homeownership aspirations. This article delves into the complexities of securing a mortgage with a lower credit score, exploring the available options, and providing valuable insights for navigating the process.

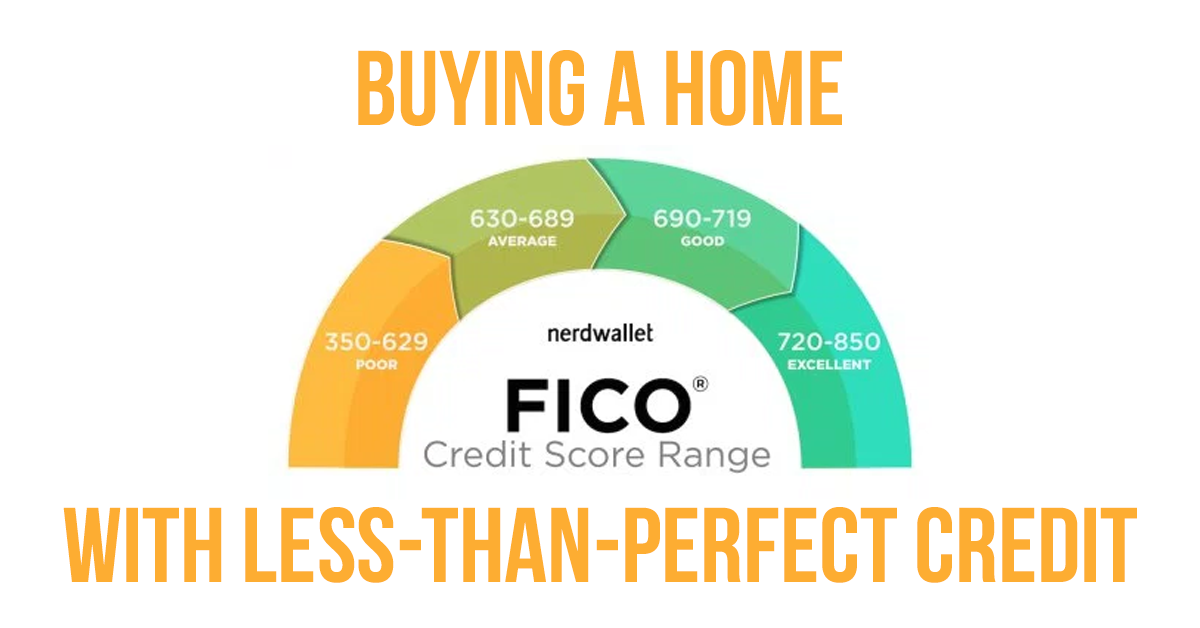

Understanding Credit Score Impact

A credit score serves as a numerical representation of an individual’s creditworthiness, reflecting their history of managing financial obligations. Lenders utilize this score to assess the risk associated with loaning money, with higher scores indicating a lower risk and therefore, more favorable loan terms. A lower credit score often translates to higher interest rates, larger down payments, and potentially more stringent loan requirements, making the journey to homeownership more challenging.

Exploring Options for Homeownership with Less-Than-Perfect Credit

While a lower credit score may present hurdles, it does not necessarily preclude homeownership. Several avenues exist for individuals to pursue their dreams, each offering unique benefits and considerations:

1. Credit Repair and Improvement:

- Focus on building positive credit: The first step involves actively improving credit scores. This entails consistently making payments on time, reducing existing debt, and avoiding new credit applications.

- Dispute errors on credit reports: Carefully review credit reports for inaccuracies and dispute any errors with the credit bureaus.

- Consider credit counseling: Seeking professional guidance from a credit counselor can provide valuable strategies for improving credit scores and developing healthy financial habits.

2. Government-Backed Loans:

- Federal Housing Administration (FHA) Loans: FHA loans offer more lenient credit score requirements compared to conventional loans. They often require lower down payments and allow for borrowers with lower credit scores to qualify.

- U.S. Department of Agriculture (USDA) Loans: USDA loans are designed for rural properties and can be particularly beneficial for those with lower credit scores, often requiring no down payment and offering flexible income requirements.

- Veterans Affairs (VA) Loans: VA loans are available to eligible veterans and active-duty military personnel. They offer competitive interest rates, no down payment requirements, and lenient credit score guidelines.

3. Non-Traditional Lending Options:

- Private Mortgage Lenders: Some private lenders specialize in working with borrowers who have less-than-perfect credit. They may offer more flexibility in terms of credit score requirements but often come with higher interest rates.

- Hard Money Loans: Hard money loans are typically short-term loans secured by real estate. They can be a viable option for borrowers with lower credit scores but often carry higher interest rates and fees.

- Seller Financing: In some instances, sellers may be willing to finance the purchase of their property, offering alternative financing options for buyers with lower credit scores.

4. Down Payment Assistance Programs:

- State and Local Programs: Many states and local governments offer down payment assistance programs to help first-time homebuyers overcome financial barriers. These programs often have eligibility requirements and may be tailored to specific geographic areas.

- Non-Profit Organizations: Non-profit organizations dedicated to affordable housing often provide down payment assistance programs, counseling services, and other resources to assist individuals with lower credit scores.

5. Building a Strong Financial Foundation:

- Saving for a Down Payment: Even with lower credit scores, having a substantial down payment can improve loan terms and increase the likelihood of approval.

- Managing Debt: Reducing existing debt, especially high-interest debt, can significantly improve credit scores and make loan applications more attractive to lenders.

- Demonstrating Stable Income: Maintaining consistent employment and a reliable income stream helps demonstrate financial stability to lenders.

FAQs about Homeownership with Less-Than-Perfect Credit

Q: What credit score is needed to buy a house?

A: While there is no universal credit score requirement for homeownership, lenders generally prefer scores above 620. However, government-backed loans like FHA loans may offer more flexibility, accepting scores as low as 580.

Q: What are the risks of buying a house with bad credit?

A: Borrowers with lower credit scores may face higher interest rates, larger down payments, and stricter loan requirements, potentially increasing the overall cost of homeownership.

Q: How can I improve my credit score before buying a house?

A: Focus on paying bills on time, reducing existing debt, and avoiding new credit applications. Dispute any errors on credit reports and consider credit counseling for guidance.

Q: Are there any government programs to help people with bad credit buy a house?

A: Yes, government-backed loans like FHA, USDA, and VA loans offer more lenient credit score requirements and can be beneficial for individuals with less-than-perfect credit.

Q: What are some alternative financing options for people with bad credit?

A: Private mortgage lenders, hard money loans, and seller financing can provide alternative financing options, though they may come with higher interest rates and fees.

Tips for Homeownership with Less-Than-Perfect Credit

- Start early: Begin improving credit scores as early as possible to give yourself ample time to build a stronger financial foundation.

- Seek professional guidance: Consult with a mortgage lender or credit counselor for personalized advice and tailored strategies.

- Explore all available options: Thoroughly research different loan programs, financing options, and down payment assistance programs to find the best fit.

- Be prepared for challenges: The process of securing a mortgage with less-than-perfect credit may involve additional steps and hurdles. Stay persistent and maintain open communication with lenders.

Conclusion

While a lower credit score can pose challenges, it does not have to be a barrier to homeownership. By actively improving credit scores, exploring available options, and building a strong financial foundation, individuals can navigate the path to homeownership and achieve their dreams. Remember, persistence, research, and a proactive approach can unlock opportunities for realizing the goal of homeownership, even with less-than-perfect credit.

![Your Journey to Homeownership [INFOGRAPHIC] - Christine Pervan Mid America Mortgage, Inc.](http://mtg-lady.com/wp-content/uploads/2021/11/20211119-MEM.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Path to Homeownership with Less-Than-Perfect Credit. We thank you for taking the time to read this article. See you in our next article!