Navigating The Path To Homeownership With Less-Than-Perfect Credit

Navigating the Path to Homeownership with Less-Than-Perfect Credit

Related Articles: Navigating the Path to Homeownership with Less-Than-Perfect Credit

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Path to Homeownership with Less-Than-Perfect Credit. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Path to Homeownership with Less-Than-Perfect Credit

The dream of owning a home is a powerful motivator for many, but for individuals with less-than-perfect credit, this dream can seem distant and unattainable. However, acquiring a home with a lower credit score is not impossible. While the process may require more effort and patience, it is achievable with careful planning, research, and the right strategies. This article provides a comprehensive guide for navigating the complexities of homeownership with less-than-perfect credit, highlighting the importance of understanding the challenges, exploring available options, and developing a roadmap to success.

Understanding the Challenges of Buying a Home with Less-Than-Perfect Credit

Credit scores play a pivotal role in determining loan eligibility and interest rates. A lower credit score signals a higher risk to lenders, often resulting in:

- Higher Interest Rates: Lenders compensate for the perceived risk by charging higher interest rates on mortgages for borrowers with lower credit scores. This means paying more over the life of the loan, increasing the overall cost of homeownership.

- Limited Loan Options: Not all lenders offer mortgages to borrowers with less-than-perfect credit. Some may have stricter credit score requirements, limiting the available loan options.

- Higher Down Payment Requirements: Some lenders may require a larger down payment for borrowers with lower credit scores to mitigate the perceived risk.

Exploring Options for Homeownership with Less-Than-Perfect Credit

Despite the challenges, several options are available for individuals seeking homeownership with less-than-perfect credit. These strategies can help improve credit scores, access financing, and ultimately achieve the dream of homeownership:

- Credit Repair: The first step is to address the root cause of the lower credit score. This involves understanding the factors impacting the score, such as late payments, high credit utilization, or negative entries on the credit report. By taking proactive steps to improve these factors, individuals can increase their credit score over time.

- Mortgage Programs for Low Credit Scores: Several government-backed programs, such as FHA loans and USDA loans, are designed to assist borrowers with lower credit scores. These programs often have more lenient credit score requirements and flexible down payment options.

- Private Lenders: Some private lenders specialize in providing mortgages to borrowers with less-than-perfect credit. These lenders may have higher interest rates, but they offer an alternative for individuals who may not qualify for traditional loans.

- Co-Signer: Having a co-signer with a strong credit history can significantly improve loan eligibility and reduce interest rates. The co-signer assumes responsibility for the loan if the primary borrower defaults, making the loan more attractive to lenders.

- Down Payment Assistance Programs: Several programs offer financial assistance for down payments, making homeownership more accessible for individuals with lower credit scores. These programs may have specific eligibility requirements and income limitations.

Tips for Building a Strong Financial Foundation for Homeownership

- Establish a Budget: A detailed budget helps track expenses, identify areas for savings, and plan for future financial goals. It provides a clear picture of income and expenses, allowing for more informed financial decisions.

- Save for a Down Payment: A substantial down payment can significantly reduce the loan amount and interest payments, making the mortgage more manageable.

- Pay Bills on Time: Consistent on-time payments are crucial for building a strong credit history. Late payments negatively impact credit scores, making it harder to qualify for loans.

- Reduce Debt: High debt levels can lower credit scores and make it challenging to secure a mortgage. Prioritizing debt repayment can improve creditworthiness and increase loan eligibility.

- Seek Financial Counseling: A qualified financial counselor can provide personalized advice, help develop a budget, and offer strategies for improving credit scores.

Frequently Asked Questions

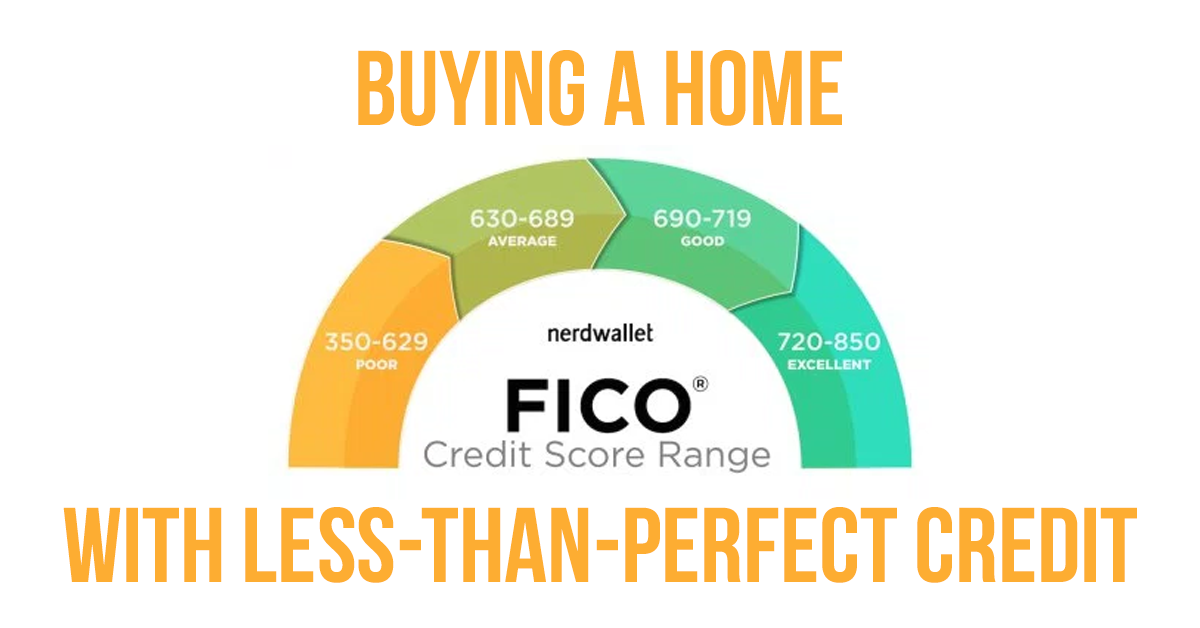

Q: What credit score is considered "bad" for a mortgage?

A: While there’s no universal definition of a "bad" credit score, lenders generally consider scores below 620 to be less than ideal. However, each lender has its own criteria, and some may be willing to work with borrowers with scores as low as 580.

Q: How long does it take to improve my credit score?

A: The time it takes to improve a credit score varies depending on the severity of the issues and the steps taken. It typically takes several months to see significant improvement, but consistent effort can lead to noticeable changes within a year or two.

Q: Are there any other ways to purchase a home with bad credit besides a mortgage?

A: While mortgages are the most common financing option, alternative methods exist. These include:

- Rent-to-Own: This allows individuals to rent a property with the option to purchase it at a predetermined price after a specified period.

- Owner Financing: Some sellers may be willing to finance the purchase directly, offering more flexibility for borrowers with less-than-perfect credit.

Conclusion

Buying a home with less-than-perfect credit requires diligence, patience, and a strategic approach. Understanding the challenges, exploring available options, and developing a strong financial foundation are essential for navigating this journey. By taking proactive steps to improve credit scores, seeking guidance from financial professionals, and exploring alternative financing options, individuals can turn the dream of homeownership into a reality, even with less-than-perfect credit. Remember, while the path may be more challenging, it is not insurmountable, and with the right guidance and determination, homeownership can be achieved.

![Your Journey to Homeownership [INFOGRAPHIC] - Christine Pervan Mid America Mortgage, Inc.](http://mtg-lady.com/wp-content/uploads/2021/11/20211119-MEM.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Path to Homeownership with Less-Than-Perfect Credit. We appreciate your attention to our article. See you in our next article!