Navigating The Path To Homeownership With Less-Than-Perfect Credit

Navigating the Path to Homeownership with Less-Than-Perfect Credit

Related Articles: Navigating the Path to Homeownership with Less-Than-Perfect Credit

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Path to Homeownership with Less-Than-Perfect Credit. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Path to Homeownership with Less-Than-Perfect Credit

The dream of owning a home is a universal aspiration, yet for many individuals with less-than-perfect credit, this dream can seem distant and unattainable. The complexities of the mortgage market, coupled with the stringent credit score requirements, can create a daunting obstacle course. However, acquiring a home is not an insurmountable hurdle, even with a less-than-ideal credit history. This comprehensive guide provides a roadmap to navigate the intricacies of homeownership with a focus on strategies tailored for individuals seeking to overcome credit-related challenges.

Understanding the Credit Score Landscape

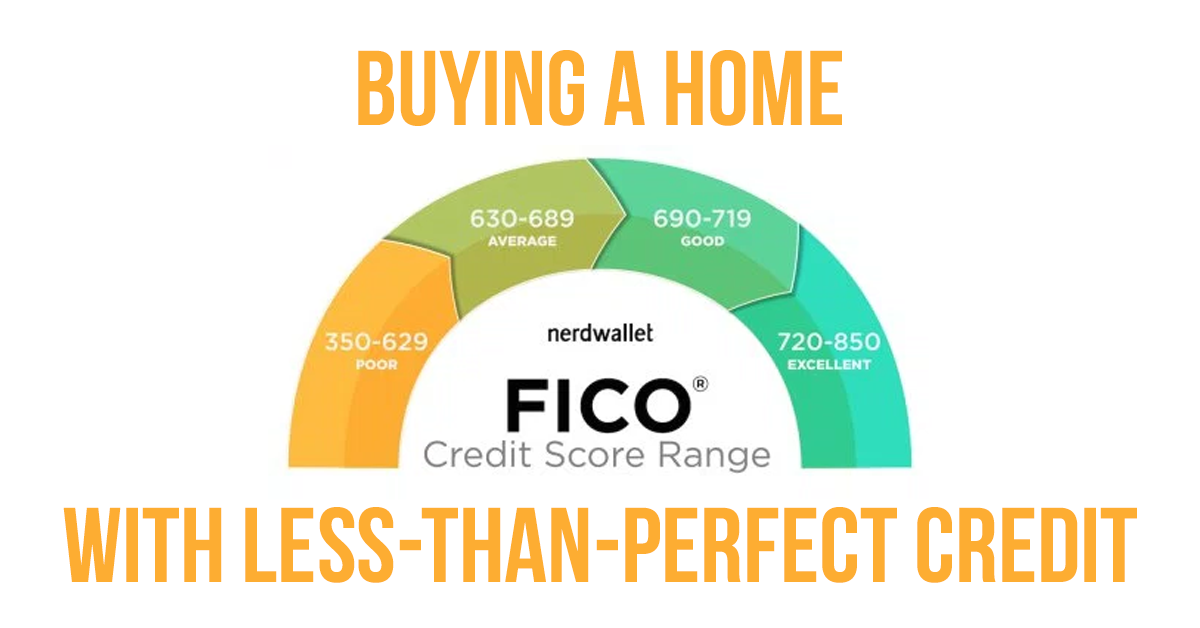

The first step in this journey is to understand the significance of a credit score and its impact on the mortgage application process. A credit score, a numerical representation of an individual’s creditworthiness, is a crucial factor that lenders rely upon to assess the risk associated with loaning money. Scores range from 300 to 850, with higher scores indicating a lower risk for lenders.

A credit score below 620 is generally considered to be "fair" or "poor," making it challenging to qualify for conventional mortgages with favorable terms. Lenders perceive individuals with lower credit scores as higher risk, often leading to higher interest rates, larger down payments, and potentially stricter loan terms.

The Importance of Financial Literacy

Before embarking on the homebuying journey, individuals with less-than-perfect credit must prioritize financial literacy. This involves gaining a comprehensive understanding of personal finance, including budgeting, debt management, and credit utilization.

-

Budgeting: Creating a detailed budget helps identify areas for financial improvement. By tracking income and expenses, individuals can identify areas for savings and prioritize debt repayment.

-

Debt Management: Reducing existing debt is crucial for improving credit scores. This can be achieved through strategies like debt consolidation, balance transfers, or snowball/avalanche methods.

-

Credit Utilization: Credit utilization refers to the amount of credit used compared to the total available credit. Keeping credit utilization low (ideally below 30%) is essential for improving credit scores.

Strategies for Building Credit

While improving credit scores requires time and effort, several strategies can expedite this process:

-

Secure Credit Cards: Secured credit cards require a security deposit that acts as collateral, making them accessible to individuals with limited credit history. Responsible use of secured credit cards can lead to improved credit scores over time.

-

Become an Authorized User: Becoming an authorized user on a credit card account with a positive payment history can positively impact credit scores. This strategy is particularly beneficial if the primary account holder has a strong credit history.

-

Pay Bills on Time: Consistent on-time payments are crucial for improving credit scores. Setting up reminders or automatic payments can help ensure timely bill payments.

-

Dispute Credit Report Errors: Errors in credit reports can negatively impact credit scores. Individuals should review their credit reports regularly and dispute any inaccuracies with the credit bureaus.

Exploring Alternative Loan Options

While conventional mortgages may be less accessible for individuals with lower credit scores, alternative loan options exist:

-

FHA Loans: The Federal Housing Administration (FHA) offers government-insured mortgages with more lenient credit score requirements and lower down payments compared to conventional loans.

-

VA Loans: The Department of Veterans Affairs (VA) offers mortgages specifically for veterans, active-duty military personnel, and surviving spouses. VA loans typically require no down payment and offer competitive interest rates.

-

USDA Loans: The United States Department of Agriculture (USDA) offers rural housing loans with lower credit score requirements and no down payment for eligible borrowers.

-

Private Loans: Private lenders, including banks and credit unions, may offer loans with more flexible credit score requirements, though interest rates may be higher.

Navigating the Mortgage Application Process

The mortgage application process for individuals with less-than-perfect credit requires meticulous preparation and strategic planning:

-

Shop Around for Lenders: Compare rates and terms from multiple lenders to secure the most favorable loan option.

-

Gather Necessary Documentation: Prepare all required documentation, including pay stubs, tax returns, bank statements, and credit reports.

-

Be Transparent with Lenders: Be upfront about credit history and any mitigating factors that may have contributed to lower credit scores.

-

Consider a Co-Signer: A co-signer with strong credit can improve loan approval chances and potentially secure lower interest rates.

Tips for Success

-

Seek Professional Guidance: Consult with a mortgage broker or financial advisor to navigate the complexities of the mortgage process and explore loan options tailored to individual circumstances.

-

Maintain Financial Discipline: Continue to practice sound financial habits, including budgeting, debt management, and responsible credit utilization, even after securing a mortgage.

-

Build a Strong Credit History: Over time, consistent responsible financial behavior will lead to improved credit scores, opening doors to more favorable loan options in the future.

Frequently Asked Questions

Q: Can I buy a home with bad credit?

A: Yes, it is possible to buy a home with less-than-perfect credit, but it may require exploring alternative loan options, such as FHA, VA, or USDA loans, or working with private lenders who have more flexible credit score requirements.

Q: What is a good credit score for a mortgage?

A: While a credit score of 620 is generally considered the minimum for conventional mortgages, higher scores often lead to more favorable loan terms, including lower interest rates and down payments.

Q: How long does it take to improve my credit score?

A: Improving credit scores takes time and consistent effort. It can take several months to a year or more to see significant improvement, depending on the starting credit score and the strategies employed.

Q: What if I am denied a mortgage?

A: If a mortgage application is denied, it is essential to understand the reasons for the denial and work towards addressing those issues. This may involve improving credit scores, increasing savings, or exploring alternative loan options.

Conclusion

Purchasing a home with less-than-perfect credit requires a strategic approach, careful planning, and a commitment to financial discipline. While the journey may be challenging, it is not insurmountable. By understanding the intricacies of credit scores, exploring alternative loan options, and consistently building a strong financial foundation, individuals with less-than-perfect credit can navigate the path to homeownership and achieve their dream of owning a home.

![Your Journey to Homeownership [INFOGRAPHIC] - Christine Pervan Mid America Mortgage, Inc.](http://mtg-lady.com/wp-content/uploads/2021/11/20211119-MEM.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Path to Homeownership with Less-Than-Perfect Credit. We hope you find this article informative and beneficial. See you in our next article!