Navigating The Path To Probate Property Ownership In The UK

Navigating the Path to Probate Property Ownership in the UK

Related Articles: Navigating the Path to Probate Property Ownership in the UK

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Path to Probate Property Ownership in the UK. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Path to Probate Property Ownership in the UK

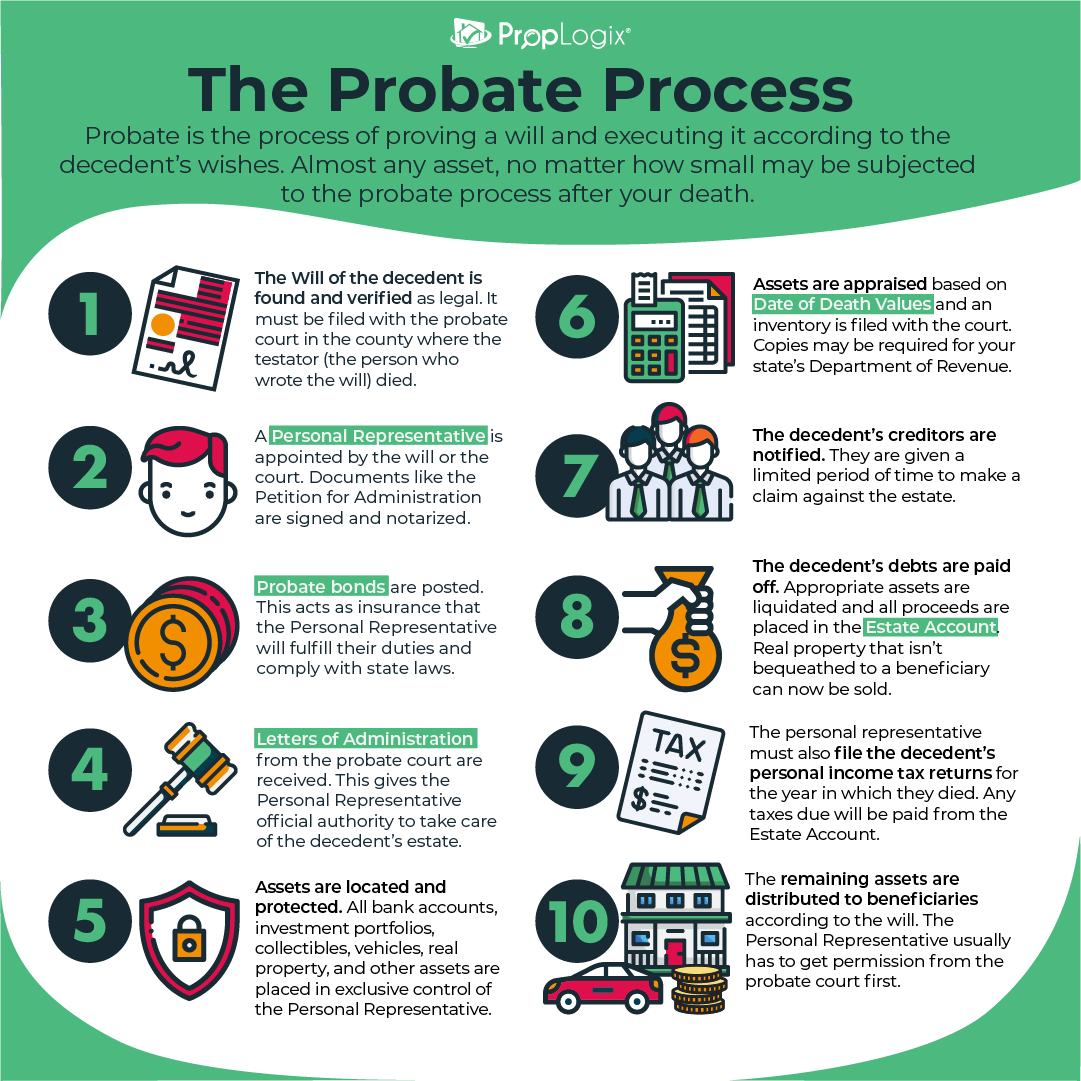

Probate property, often referred to as "deceased estate property," presents a unique opportunity for prospective buyers in the UK. It encompasses real estate that is owned by someone who has passed away and is now subject to the legal process of probate. This process involves verifying the deceased’s will, settling their debts, and distributing their assets to rightful beneficiaries. While navigating this legal landscape can seem daunting, understanding the intricacies of buying probate property can unlock significant benefits for astute buyers.

Understanding Probate and Its Impact on Property Ownership

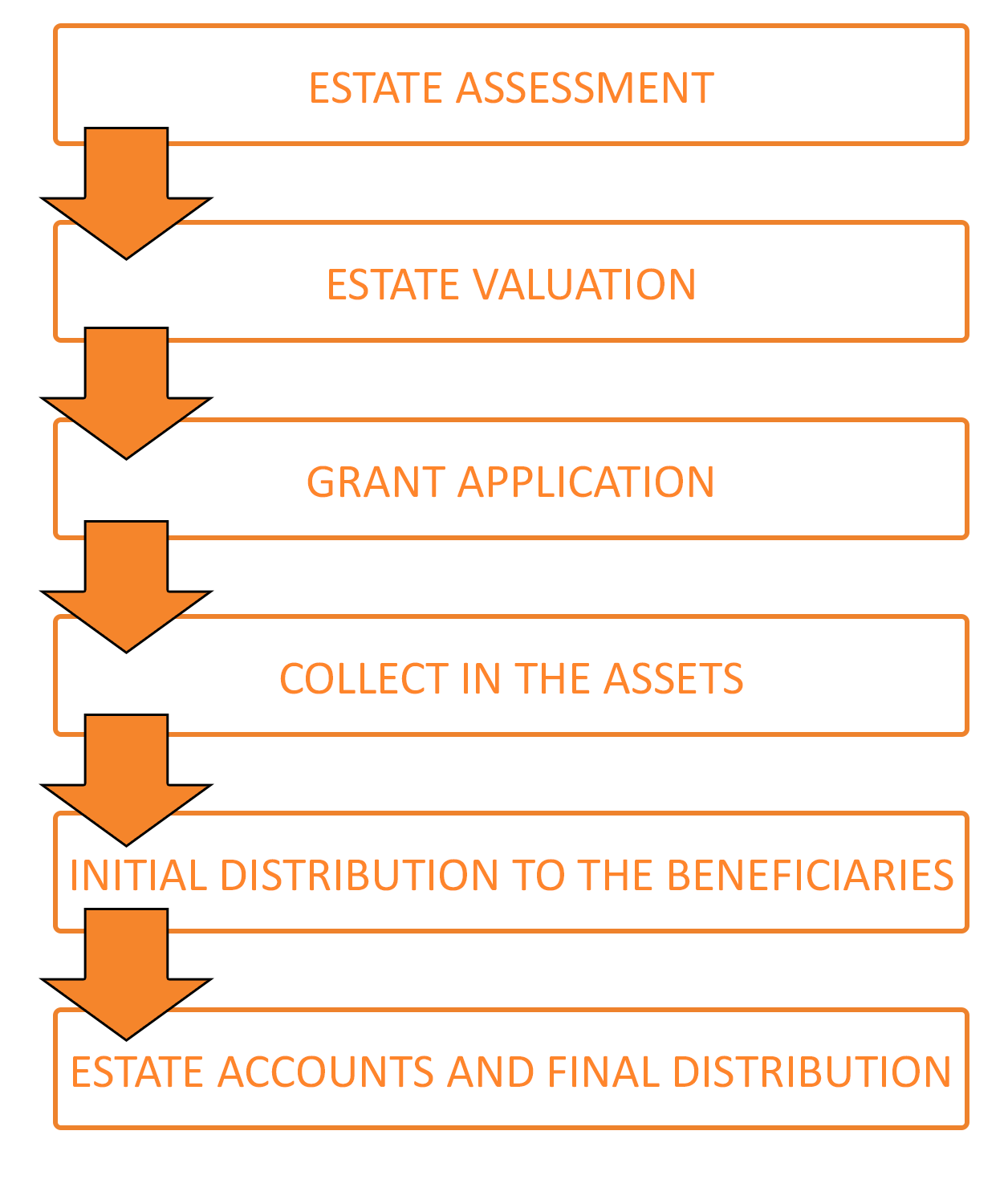

Probate is the legal process of administering a deceased person’s estate. This process begins with the appointment of an executor, a person named in the will or appointed by the court, who is responsible for carrying out the deceased’s wishes regarding their assets. The executor is tasked with collecting the deceased’s assets, paying off their debts, and distributing the remaining estate to beneficiaries according to the will.

When a property is part of a deceased’s estate, it becomes probate property. This property cannot be sold until the probate process is complete. The executor must obtain a Grant of Probate, a legal document that grants them the authority to deal with the deceased’s property. This document is essential for transferring ownership of the property to the new owner.

The Advantages of Buying Probate Property

Buying probate property can offer several advantages over traditional property purchases:

- Potential for Lower Prices: Probate property is often offered at a discount compared to properties on the open market. This is because executors may be motivated to sell quickly, especially if the beneficiaries are eager to receive their inheritance.

- Unique Opportunities: Probate properties can present unique opportunities to acquire properties that might not be readily available on the open market. This includes properties with special features, historical significance, or located in desirable areas.

- Less Competition: Due to the unique circumstances surrounding probate property, there is often less competition from other buyers, increasing the chances of securing a desirable property.

The Challenges of Buying Probate Property

While buying probate property offers potential benefits, it also comes with unique challenges:

- Extended Timeframes: The probate process can be lengthy, often taking several months or even years to complete. This can be frustrating for buyers who are eager to move into their new home.

- Uncertainty and Delays: The probate process can be unpredictable, with potential delays due to legal disputes, missing beneficiaries, or complex estate issues.

- Limited Information: Buyers may have limited access to information about the property’s history and condition, as the executor may not have full knowledge of all details.

Navigating the Purchase Process: Essential Steps

Buying probate property requires a different approach compared to traditional property purchases. Here are the key steps to navigate the process:

- Identify Potential Properties: Start by researching probate property listings through specialized estate agents, online platforms, or local newspapers.

- Engage with the Executor: Once you have identified a property of interest, contact the executor to express your interest and inquire about the details of the estate.

- Due Diligence: Conduct thorough due diligence, including obtaining a copy of the deceased’s will, reviewing the property’s title deeds, and conducting a property survey.

- Negotiate the Purchase Price: Negotiate a fair purchase price with the executor, taking into account the property’s condition, market value, and the potential for delays.

- Secure Financing: Secure a mortgage from a lender who is willing to finance a probate property purchase.

- Legal Consultation: Consult with a solicitor to review the legal documents and ensure a smooth and legally sound transaction.

- Exchange of Contracts: Once all legal requirements are met, exchange contracts with the executor, legally binding you to the purchase.

- Completion and Transfer of Ownership: Complete the transaction and obtain the Grant of Probate, transferring ownership of the property to your name.

Frequently Asked Questions (FAQs) about Buying Probate Property

Q: How do I find probate property listings?

A: Probate property listings can be found through specialized estate agents, online platforms like Rightmove or Zoopla, local newspapers, and word-of-mouth.

Q: What documents should I review during due diligence?

A: During due diligence, review the deceased’s will, property title deeds, planning permissions, building regulations compliance, and any relevant surveys.

Q: How long does the probate process typically take?

A: The probate process can take several months or even years to complete, depending on the complexity of the estate and any legal challenges.

Q: What are the risks involved in buying probate property?

A: Risks include potential delays, legal disputes, hidden property defects, and limited information about the property’s history.

Q: Can I obtain a mortgage on a probate property?

A: Yes, but some lenders may be hesitant to provide mortgages for probate properties due to the potential complexities and delays.

Q: What happens if the executor refuses my offer?

A: If the executor refuses your offer, you can consider making a counteroffer or exploring other probate property options.

Tips for Buying Probate Property

- Be Patient: The probate process can be time-consuming, so be prepared for potential delays and uncertainties.

- Thorough Due Diligence: Conduct comprehensive due diligence to avoid unexpected surprises and potential legal complications.

- Consult with Experts: Engage a solicitor and a surveyor to guide you through the legal and technical aspects of the purchase.

- Understand the Risks: Be aware of the potential risks involved in buying probate property and factor them into your decision.

- Negotiate Strategically: Negotiate a fair purchase price, taking into account the property’s condition, market value, and the potential for delays.

Conclusion

Buying probate property can offer unique opportunities to acquire desirable properties at potentially lower prices. However, it’s crucial to approach this process with caution and a thorough understanding of the legal and practical complexities involved. By engaging with the right professionals, conducting thorough due diligence, and exercising patience, buyers can navigate the intricacies of probate property ownership and unlock its potential benefits. Remember, a well-informed and strategic approach can pave the way for a successful and rewarding property acquisition journey.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Path to Probate Property Ownership in the UK. We appreciate your attention to our article. See you in our next article!