The Rise Of Flexible Financing: Examining Buy Now, Pay Later For Household Essentials

The Rise of Flexible Financing: Examining Buy Now, Pay Later for Household Essentials

Related Articles: The Rise of Flexible Financing: Examining Buy Now, Pay Later for Household Essentials

Introduction

With great pleasure, we will explore the intriguing topic related to The Rise of Flexible Financing: Examining Buy Now, Pay Later for Household Essentials. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Rise of Flexible Financing: Examining Buy Now, Pay Later for Household Essentials

:max_bytes(150000):strip_icc()/buy-now-pay-later-5182291-final-4dcaa9bea32a4aa398eb99e5ca5406bb.png)

The modern consumer landscape is marked by a shift towards flexible payment options. Buy now, pay later (BNPL) schemes have emerged as a dominant force, particularly in the realm of household goods and appliances. This article delves into the nuances of BNPL for household items, exploring its benefits, potential drawbacks, and its implications for both consumers and the retail industry.

Understanding Buy Now, Pay Later for Household Items

Buy now, pay later, in the context of household items, refers to a financing method that allows consumers to purchase essential goods like furniture, appliances, kitchenware, and home décor without paying the full price upfront. Instead, they make a series of smaller payments over a predetermined period, typically interest-free. This installment-based approach has gained immense popularity, driven by a confluence of factors:

1. Accessibility and Convenience: BNPL schemes are often readily available at the point of sale, both online and in physical stores. This accessibility removes the need for traditional credit checks and lengthy loan applications, making it a convenient option for consumers seeking immediate gratification.

2. Financial Flexibility: For budget-conscious individuals, BNPL offers the ability to spread out the cost of a large purchase, making it more manageable. This flexibility allows consumers to prioritize essential items without straining their immediate financial resources.

3. Interest-Free Periods: A significant draw of BNPL is the often-advertised interest-free periods. This feature is particularly appealing to consumers who can fully repay their purchase within the designated timeframe, avoiding any additional financial burden.

4. Building Credit History: For individuals without established credit histories, BNPL can serve as a stepping stone towards building creditworthiness. Timely repayments on BNPL loans can positively impact credit scores, opening doors to future financial opportunities.

Benefits of BNPL for Household Items

1. Improved Affordability: BNPL empowers consumers to purchase necessary household items, like a new washing machine or a comfortable sofa, without feeling immediate financial pressure. This improved affordability can enhance quality of life and address essential needs.

2. Budget Management: By breaking down large purchases into smaller installments, BNPL can aid in budgeting and financial planning. Consumers can better control their spending and avoid unexpected financial strain.

3. Access to Higher-Quality Goods: BNPL can facilitate the purchase of higher-quality household items that might otherwise be out of reach due to upfront costs. This access to premium products can enhance the overall functionality and aesthetic appeal of a home.

4. Enhanced Shopping Experience: The integration of BNPL into online and physical retail environments offers a seamless and convenient shopping experience. Consumers can enjoy a streamlined checkout process and immediate access to their purchases.

Potential Drawbacks of BNPL for Household Items

1. Overspending: The ease of access and interest-free periods associated with BNPL can tempt consumers to overspend. This can lead to a cycle of accumulating debt if purchases are not carefully considered and repayment plans are not adhered to.

2. Hidden Fees and Interest: While many BNPL schemes offer interest-free periods, late payment fees, missed payment penalties, and potential interest charges can quickly accrue if payments are not made on time. These hidden costs can significantly impact the overall financial burden of the purchase.

3. Impact on Credit Scores: While timely repayments can positively impact credit scores, missed or late payments can negatively affect credit history, potentially hindering access to future loans or credit cards.

4. Dependence on BNPL: Overreliance on BNPL can create a dependency on installment-based financing, potentially hindering long-term financial stability. It’s crucial to use BNPL responsibly and avoid relying on it as a primary source of financing.

FAQs Regarding BNPL for Household Items

1. How does BNPL work for household items?

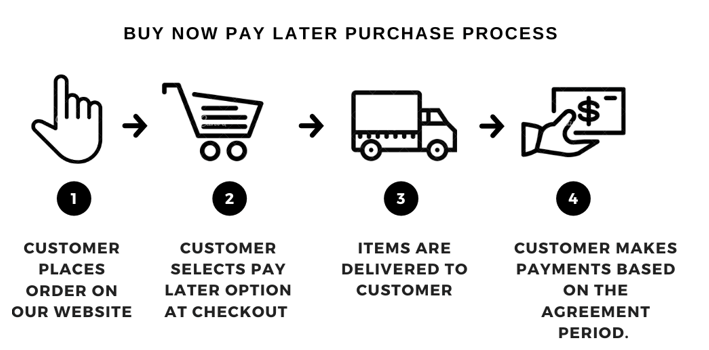

BNPL providers typically partner with retailers to offer financing options at the point of sale. When purchasing a household item, consumers can choose to pay in installments through a BNPL platform. The retailer receives the full payment upfront, while the consumer makes regular payments to the BNPL provider.

2. Are there any interest charges associated with BNPL?

Many BNPL schemes offer interest-free periods, allowing consumers to repay the purchase in full within a specified timeframe without incurring interest charges. However, late payment fees, missed payment penalties, and potential interest charges can apply if payments are not made on time.

3. What are the eligibility criteria for BNPL?

Eligibility requirements for BNPL can vary depending on the provider. Generally, most platforms require consumers to be at least 18 years old, have a valid bank account, and have a good credit history. Some providers may also conduct soft credit checks to assess creditworthiness.

4. Is BNPL suitable for everyone?

BNPL can be a beneficial financing option for responsible consumers who can manage their repayments effectively. However, it’s not suitable for everyone, particularly those struggling with debt or who have a history of late payments. It’s crucial to evaluate personal financial circumstances and repayment capabilities before opting for BNPL.

5. How can I avoid the potential drawbacks of BNPL?

To minimize the risks associated with BNPL, it’s essential to:

- Shop around and compare offers: Explore different BNPL providers to find the most suitable terms and conditions.

- Calculate the total cost: Factor in potential late fees and interest charges before making a purchase.

- Set a budget and stick to it: Avoid overspending and ensure you can comfortably make repayments within the designated timeframe.

- Prioritize repayment: Make timely payments to avoid penalties and maintain a positive credit history.

Tips for Utilizing BNPL for Household Items

1. Prioritize Essential Purchases: Use BNPL for essential household items that enhance your quality of life or address immediate needs, rather than for impulsive purchases.

2. Consider the Long-Term Cost: Carefully calculate the total cost of the purchase, including potential interest charges and late fees, to ensure it fits within your budget.

3. Set Up Payment Reminders: Utilize calendar reminders or automatic payment features to avoid missed payments and potential penalties.

4. Monitor Your Spending: Track your BNPL payments and ensure they are within your overall budget. Avoid accumulating multiple BNPL loans simultaneously.

5. Seek Help When Needed: If you find yourself struggling to make repayments, contact your BNPL provider to discuss options like payment extensions or repayment plans.

Conclusion: A Balanced Perspective on BNPL for Household Items

Buy now, pay later has emerged as a significant force in the retail landscape, particularly for household goods. It offers consumers flexibility and affordability, enabling access to essential items and enhancing quality of life. However, responsible utilization is paramount to avoid potential drawbacks like overspending and debt accumulation. By adhering to best practices, consumers can leverage the benefits of BNPL while safeguarding their financial well-being. Ultimately, the success of BNPL for household items hinges on a balanced approach, prioritizing responsible spending and maintaining a clear understanding of the associated costs and risks.

![]()

![]()

Closure

Thus, we hope this article has provided valuable insights into The Rise of Flexible Financing: Examining Buy Now, Pay Later for Household Essentials. We thank you for taking the time to read this article. See you in our next article!