The Shifting Landscape Of Household Expenses: A Look At Average Prices

The Shifting Landscape of Household Expenses: A Look at Average Prices

Related Articles: The Shifting Landscape of Household Expenses: A Look at Average Prices

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Shifting Landscape of Household Expenses: A Look at Average Prices. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: The Shifting Landscape of Household Expenses: A Look at Average Prices

- 2 Introduction

- 3 The Shifting Landscape of Household Expenses: A Look at Average Prices

- 3.1 A Historical Perspective: The Price of Necessities

- 3.2 Factors Influencing Average Prices

- 3.3 The Importance of Average Price Data

- 3.4 FAQs about Average Prices

- 3.5 Tips for Managing Household Expenses

- 3.6 Conclusion

- 4 Closure

The Shifting Landscape of Household Expenses: A Look at Average Prices

![20+ Average Monthly Expense Statistics [2023]: Average Household Spending In America - Zippia](https://www.zippia.com/wp-content/uploads/2023/06/year-over-year-spending-changes-by-category.jpg)

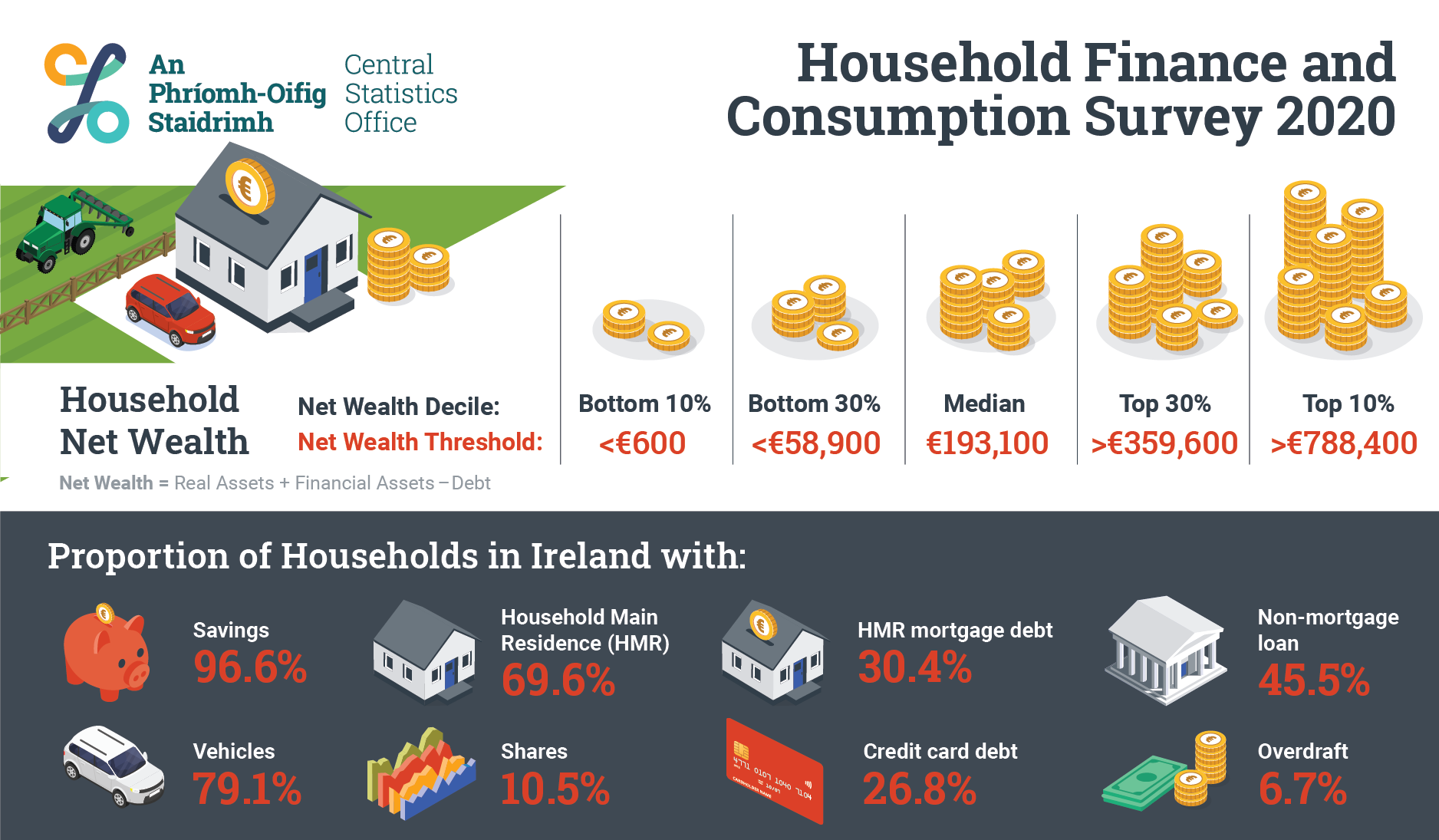

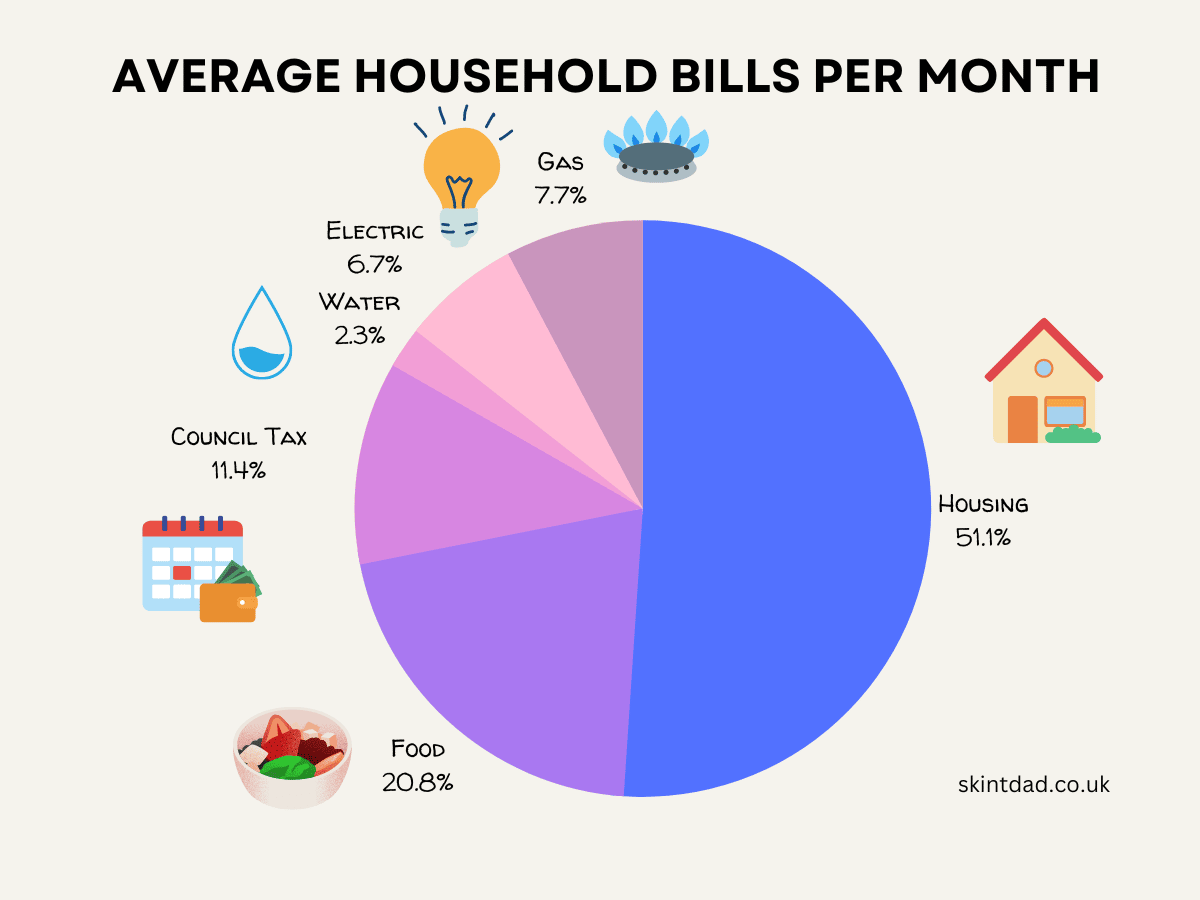

The cost of maintaining a household is a dynamic factor, influenced by a complex interplay of economic conditions, market trends, and individual choices. Understanding the average prices of common household items provides valuable insight into the financial realities of everyday life. This article delves into the evolution of these prices, examining key factors that contribute to their fluctuations, and highlighting the importance of this data for both consumers and businesses.

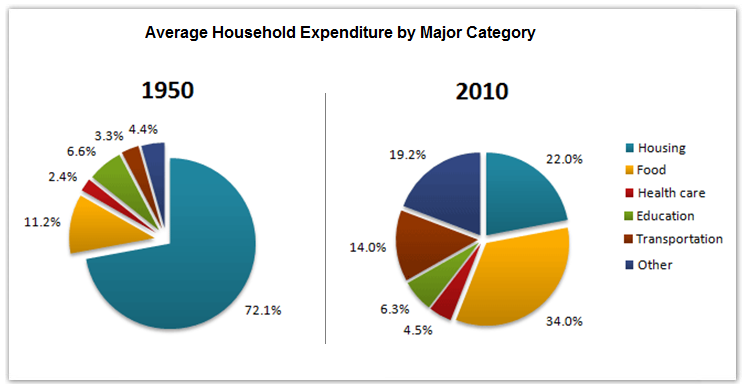

A Historical Perspective: The Price of Necessities

Tracking the average price of household items reveals a compelling narrative of economic change. In the past, certain items like food and basic appliances were considered relatively affordable, while others, such as electronics and luxury goods, were reserved for a select few. However, the passage of time has witnessed a significant shift in this paradigm.

For instance, the average price of a gallon of milk in 1950 was approximately $0.70, whereas today, it hovers around $3.50. This increase, while seemingly significant, needs to be considered in the context of inflation and income growth. Similarly, the average cost of a television set in the 1950s was around $200, while today, a comparable model can be purchased for significantly less, highlighting the impact of technological advancements and economies of scale on pricing.

Factors Influencing Average Prices

Several factors contribute to the fluctuation of average prices for household items, including:

- Inflation: The rate of inflation, which measures the general increase in prices over time, significantly impacts the cost of living. As inflation rises, the purchasing power of currency decreases, leading to higher prices for goods and services.

- Supply and Demand: The interplay of supply and demand plays a crucial role in determining prices. When demand for a particular item exceeds its supply, prices tend to rise. Conversely, if supply outpaces demand, prices may decrease.

- Raw Material Costs: The cost of raw materials used in the production of household items can influence their final price. Fluctuations in the price of oil, metal, and other materials can ripple through the supply chain, impacting the cost of goods.

- Labor Costs: Labor costs are another significant factor. Wages for workers involved in manufacturing, transportation, and retail contribute to the overall price of household items.

- Technological Advancements: Technological innovation can lead to both price increases and decreases. While some advancements may increase the cost of production initially, they can also drive down prices in the long run due to efficiency gains and increased competition.

- Government Policies: Government regulations, taxes, and subsidies can impact the price of household items. For example, tariffs on imported goods can lead to higher prices for consumers.

- Consumer Preferences: Consumer preferences and trends play a role in shaping the demand for certain products, influencing their prices. The popularity of certain brands or features can drive up prices, while declining interest in others can lead to discounts.

The Importance of Average Price Data

Understanding average prices is crucial for various stakeholders:

- Consumers: This data empowers consumers to make informed purchasing decisions. By comparing prices across different retailers and brands, consumers can identify the best value for their money.

- Businesses: Businesses rely on average price data to set competitive pricing strategies. By analyzing market trends and competitor pricing, businesses can optimize their pricing models to maximize profitability.

- Economists and Policymakers: Average price data provides valuable insights into economic trends and consumer behavior. This information helps economists and policymakers understand the impact of economic policies on household spending and inflation.

FAQs about Average Prices

Q: How are average prices calculated?

A: Average prices are typically calculated by collecting data from various sources, including retail price surveys, online marketplaces, and industry reports. The data is then aggregated and averaged to arrive at a representative figure.

Q: What is the difference between average prices and median prices?

A: Average prices represent the mean of a data set, while median prices represent the middle value when the data is ordered from lowest to highest. Median prices are often considered a more accurate reflection of typical prices, as they are less affected by outliers.

Q: How do average prices vary geographically?

A: Average prices can vary significantly across different regions due to factors such as local market conditions, transportation costs, and regional differences in consumer demand.

Q: How do average prices change over time?

A: Average prices are constantly evolving due to the factors mentioned earlier, including inflation, supply and demand, and technological advancements.

Tips for Managing Household Expenses

- Budgeting: Create a detailed budget to track income and expenses, allowing for informed spending decisions.

- Comparison Shopping: Compare prices across different retailers and brands to identify the best deals.

- Seeking Discounts: Take advantage of sales, coupons, and loyalty programs to save money.

- Negotiating: Don’t be afraid to negotiate prices, especially for large purchases.

- Prioritizing Needs over Wants: Distinguish between essential needs and discretionary wants, focusing spending on necessities.

- Avoiding Impulse Purchases: Resist the urge to make impulsive purchases by carefully considering the value of each item.

Conclusion

The average price of household items serves as a valuable indicator of economic conditions and consumer spending patterns. Understanding the factors influencing these prices empowers individuals to make informed financial decisions, while businesses can leverage this data to optimize their pricing strategies. By staying informed about market trends and adapting to changing economic realities, consumers and businesses can navigate the evolving landscape of household expenses with greater efficiency and financial well-being.

![20+ Average Monthly Expense Statistics [2023]: Average Household Spending In America - Zippia](https://www.zippia.com/wp-content/uploads/2023/06/monthly-expenses-by-average-share-of-income.png)

![20+ Average Monthly Expense Statistics [2023]: Average Household Spending In America - Zippia](https://www.zippia.com/wp-content/uploads/2023/06/average-monthly-household-expenses-over-time.png)

Closure

Thus, we hope this article has provided valuable insights into The Shifting Landscape of Household Expenses: A Look at Average Prices. We appreciate your attention to our article. See you in our next article!