Understanding The Financial Landscape Of Household Expenses

Understanding the Financial Landscape of Household Expenses

Related Articles: Understanding the Financial Landscape of Household Expenses

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding the Financial Landscape of Household Expenses. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Understanding the Financial Landscape of Household Expenses

- 2 Introduction

- 3 Understanding the Financial Landscape of Household Expenses

- 3.1 Deconstructing Household Costs: A Comprehensive Overview

- 3.2 Factors Influencing Household Costs: A Dynamic Landscape

- 3.3 The Importance of Understanding Household Costs

- 3.4 Frequently Asked Questions (FAQs)

- 3.5 Tips for Managing Household Costs

- 3.6 Conclusion

- 4 Closure

Understanding the Financial Landscape of Household Expenses

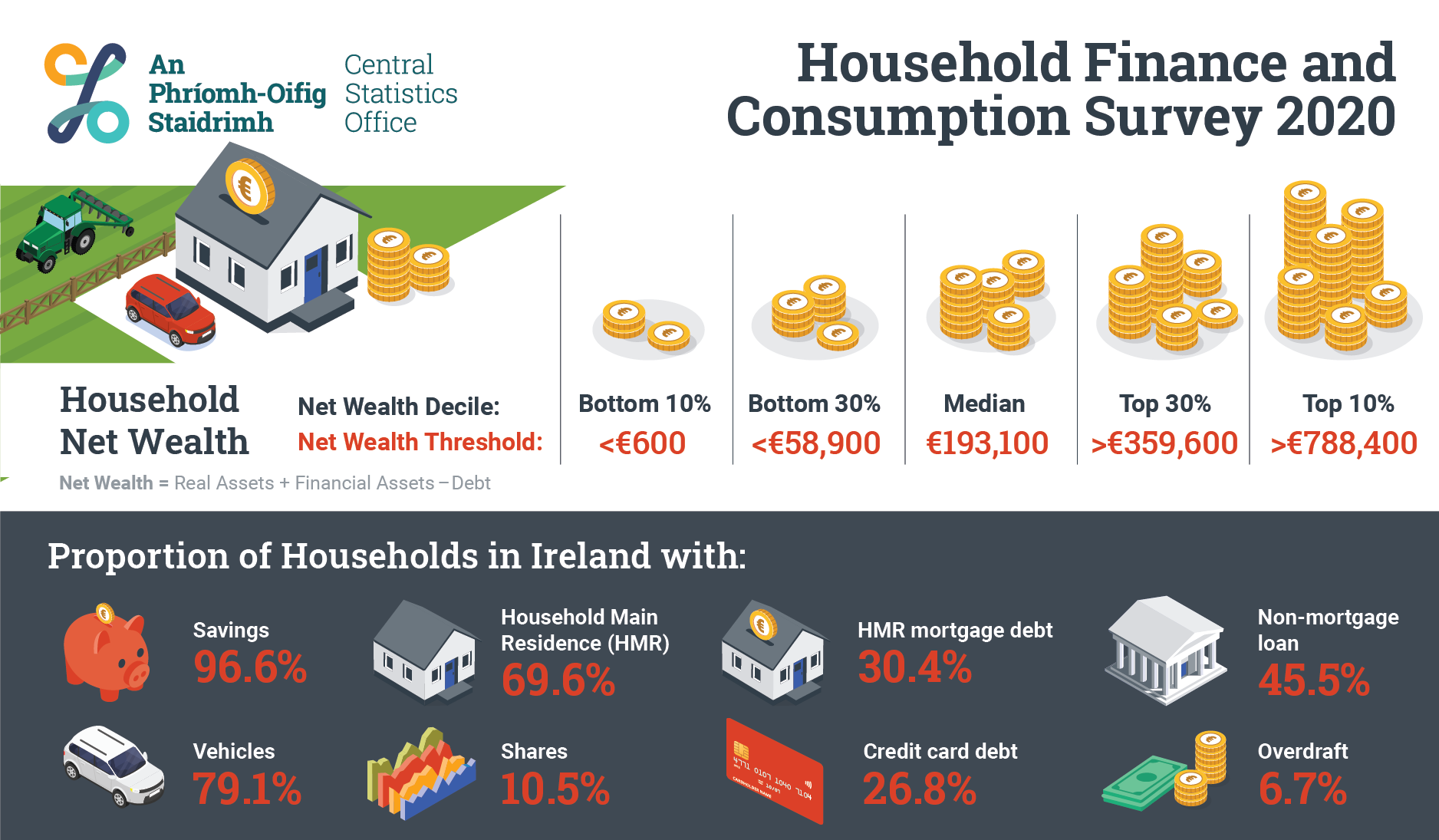

The cost of living is a fundamental aspect of modern life, encompassing a wide array of expenditures necessary to sustain a household. These expenses, collectively known as household costs, are crucial to understand for individuals and families alike, as they directly impact financial stability and well-being.

This article delves into the intricacies of household costs, providing a comprehensive analysis of their components, factors influencing their fluctuations, and the implications they hold for personal budgeting and financial planning.

Deconstructing Household Costs: A Comprehensive Overview

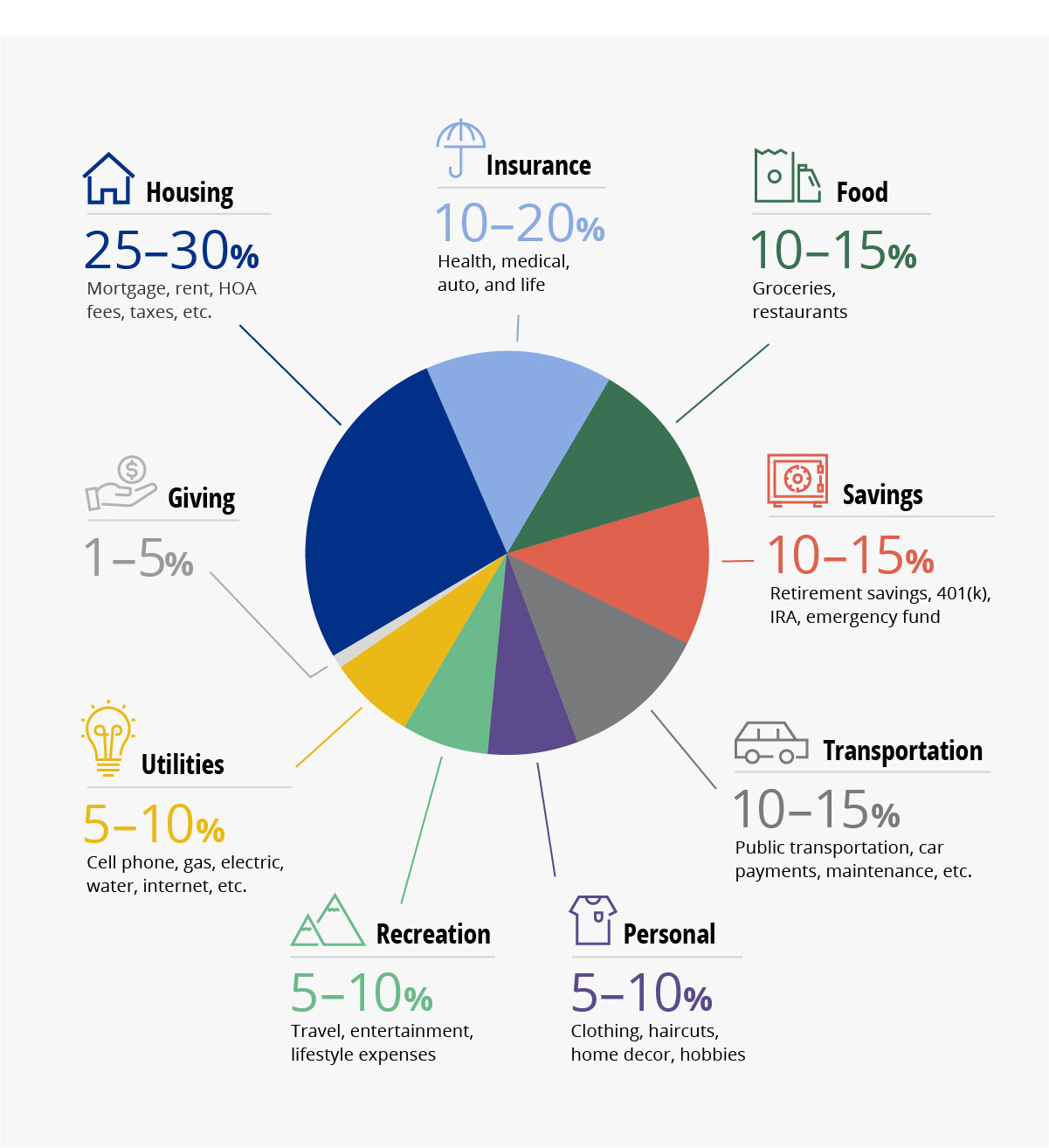

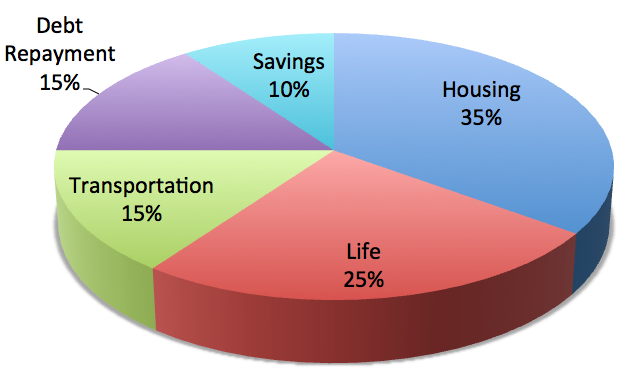

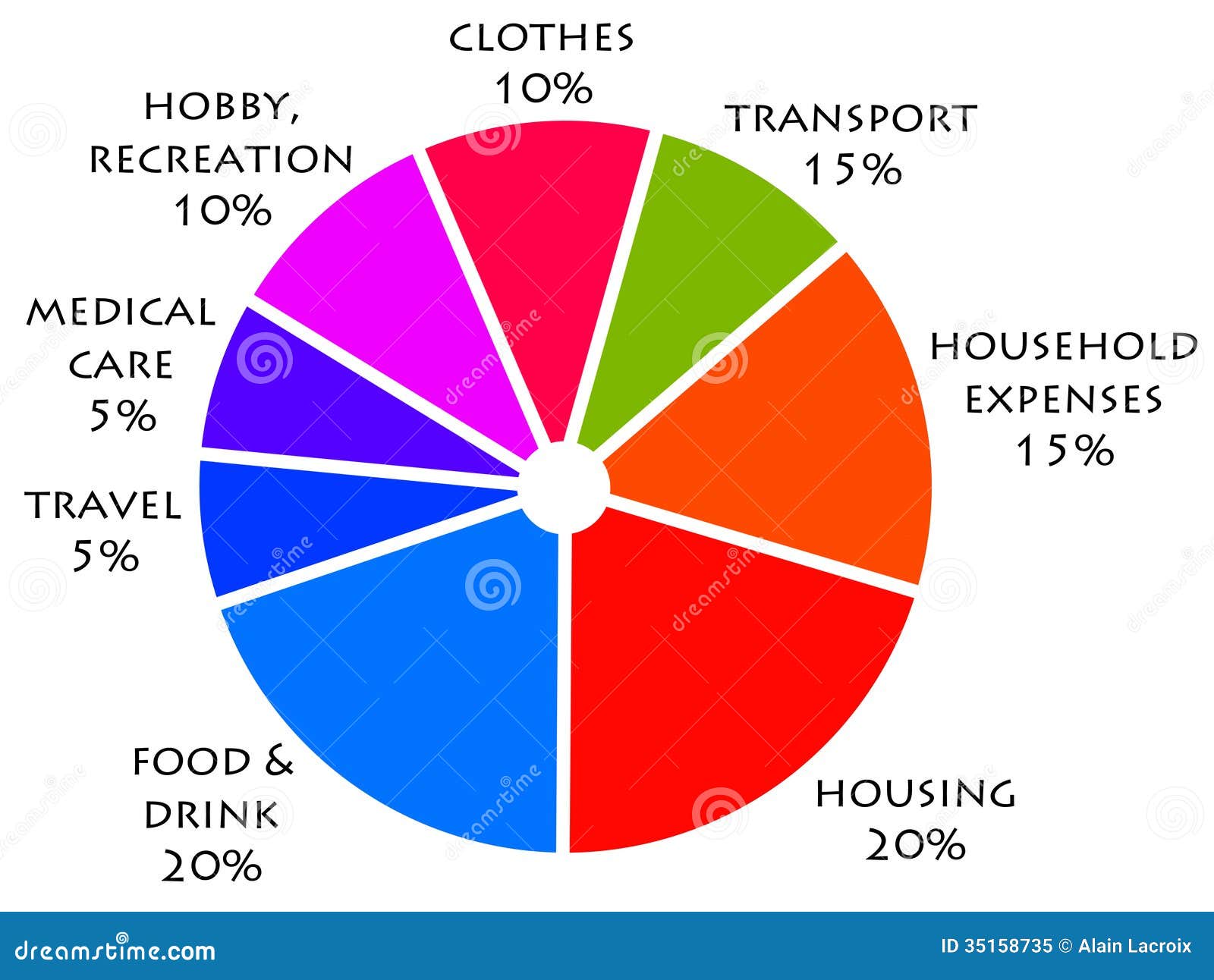

Household costs encompass a diverse range of expenditures, categorized into essential and discretionary categories:

Essential Expenses: These are non-negotiable costs vital for basic survival and well-being. They include:

- Housing: Rent or mortgage payments, property taxes, insurance, and maintenance costs.

- Utilities: Electricity, gas, water, and sewage services.

- Food: Groceries, dining out, and meal delivery services.

- Transportation: Vehicle ownership costs (gas, insurance, maintenance, loan payments), public transportation fares, and ride-sharing services.

- Healthcare: Health insurance premiums, out-of-pocket medical expenses, and prescription drugs.

- Childcare: Costs associated with daycare, preschool, and after-school programs.

- Education: Tuition fees, books, and other educational expenses for children and adults.

Discretionary Expenses: These are costs associated with non-essential items and services that provide comfort, entertainment, and leisure. They include:

- Entertainment: Movies, concerts, sporting events, and subscriptions to streaming services.

- Travel: Vacations, flights, hotels, and travel insurance.

- Clothing and Personal Care: Apparel, footwear, toiletries, and beauty products.

- Hobbies and Leisure Activities: Sporting equipment, musical instruments, and other recreational pursuits.

- Dining Out and Socializing: Restaurant meals, bars, and social gatherings.

- Gifts: Presents for birthdays, holidays, and special occasions.

- Savings and Investments: Contributions to retirement accounts, savings for future goals, and investments.

Factors Influencing Household Costs: A Dynamic Landscape

Household costs are not static but fluctuate based on several factors, including:

- Geographic Location: Cost of living varies significantly across different regions and cities, influenced by factors like housing market, local taxes, and availability of goods and services.

- Household Size and Composition: Larger families tend to have higher expenses for food, housing, and transportation. The presence of children and dependents also influences childcare and education costs.

- Income Level: Higher-income households generally spend more on discretionary items like travel, entertainment, and dining out.

- Lifestyle Choices: Individual preferences and lifestyle choices, such as dining out frequently or owning multiple vehicles, impact spending patterns.

- Economic Conditions: Inflation, interest rates, and employment levels influence the cost of goods and services, affecting household expenses.

- Government Policies: Taxes, subsidies, and regulations impact the cost of housing, healthcare, and other essential items.

The Importance of Understanding Household Costs

Comprehending household costs is essential for several reasons:

- Financial Planning: Accurate budgeting requires a clear understanding of income and expenses. Knowing average household costs provides a baseline for creating a realistic budget and tracking progress.

- Debt Management: High household costs can contribute to debt accumulation. Understanding spending patterns helps identify areas for reducing expenses and improving financial stability.

- Financial Decision-Making: Informed decisions about major purchases, investments, and lifestyle choices require a grasp of household costs and their impact on financial resources.

- Negotiating and Advocacy: Knowledge of average household costs empowers individuals to advocate for fair wages, affordable housing, and accessible healthcare.

Frequently Asked Questions (FAQs)

Q1: What is the average cost of living in the United States?

A: The average cost of living in the United States varies widely based on location and household size. According to the Council for Community and Economic Research (C2ER), the average cost of living index for the United States in 2023 is 100, with some cities like New York City and San Francisco exceeding 200.

Q2: How do I calculate my own household costs?

A: To calculate your household costs, track your expenses over a period of time, such as a month or a year. Categorize your spending into essential and discretionary categories and analyze your spending patterns.

Q3: What are some ways to reduce household costs?

A: There are numerous strategies to reduce household costs, including:

- Negotiating Lower Bills: Contact utility providers, insurance companies, and telecommunications companies to negotiate lower rates.

- Conserving Energy and Water: Reduce energy consumption by using energy-efficient appliances, turning off lights when leaving rooms, and taking shorter showers.

- Eating at Home More Often: Prepare meals at home instead of dining out to reduce food expenses.

- Shopping Smart: Compare prices, buy in bulk when possible, and utilize coupons and discounts.

- Finding Affordable Transportation Options: Explore public transportation, carpooling, and biking to reduce transportation costs.

Q4: What are the biggest contributors to household costs?

A: The biggest contributors to household costs typically include housing, transportation, and food. These categories often represent a significant portion of household budgets.

Q5: How can I track my household costs?

A: There are various tools and methods for tracking household costs, including:

- Spreadsheets: Create a spreadsheet to manually record income and expenses.

- Budgeting Apps: Use budgeting apps that automate expense tracking and provide insights into spending patterns.

- Financial Management Software: Utilize financial management software that connects to bank accounts and credit cards to automatically track transactions.

Tips for Managing Household Costs

- Prioritize Needs Over Wants: Focus on essential expenses and limit discretionary spending.

- Set Realistic Financial Goals: Establish achievable goals for saving, debt reduction, and investment.

- Automate Savings: Set up automatic transfers to savings accounts to ensure regular contributions.

- Review Spending Regularly: Monitor expenses to identify areas for improvement and adjust spending habits as needed.

- Seek Professional Advice: Consult with a financial advisor to develop a personalized financial plan and receive guidance on managing household costs.

Conclusion

Understanding household costs is crucial for managing personal finances effectively. By analyzing spending patterns, identifying areas for cost reduction, and implementing strategies for budgeting and saving, individuals and families can gain control of their financial well-being. Awareness of household costs empowers individuals to make informed decisions, plan for the future, and achieve financial stability.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Financial Landscape of Household Expenses. We appreciate your attention to our article. See you in our next article!