Understanding The Value Of What We Own: A Comprehensive Look At Average Household Contents

Understanding the Value of What We Own: A Comprehensive Look at Average Household Contents

Related Articles: Understanding the Value of What We Own: A Comprehensive Look at Average Household Contents

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding the Value of What We Own: A Comprehensive Look at Average Household Contents. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Understanding the Value of What We Own: A Comprehensive Look at Average Household Contents

- 2 Introduction

- 3 Understanding the Value of What We Own: A Comprehensive Look at Average Household Contents

- 3.1 Defining the Scope: What Constitutes Household Contents?

- 3.2 Factors Influencing the Average Value of Household Contents

- 3.3 The Importance of Understanding Average Household Contents Value

- 3.4 Estimating the Average Value of Household Contents

- 3.5 Frequently Asked Questions (FAQs)

- 3.6 Tips for Determining and Managing the Value of Your Household Contents

- 3.7 Conclusion

- 4 Closure

Understanding the Value of What We Own: A Comprehensive Look at Average Household Contents

The contents of our homes are more than just furniture, appliances, and personal belongings. They represent years of accumulated memories, investments, and the very fabric of our lives. Understanding the financial value of these possessions is crucial for various reasons, ranging from insurance planning to financial stability in the face of unforeseen events. This article delves into the concept of average household contents value, its significance, and the factors that influence it.

Defining the Scope: What Constitutes Household Contents?

Before diving into the average value, it is essential to define what constitutes household contents. This encompasses a broad range of items, including:

- Furniture: Sofas, beds, tables, chairs, desks, dressers, and other furnishings.

- Appliances: Refrigerators, ovens, stoves, dishwashers, washing machines, dryers, microwaves, and other electrical appliances.

- Electronics: Televisions, computers, laptops, smartphones, tablets, audio systems, and gaming consoles.

- Personal belongings: Clothing, jewelry, books, artwork, musical instruments, sports equipment, and other items of personal value.

- Decorative items: Curtains, rugs, lamps, vases, and other decorative elements.

This list is not exhaustive, and the specific items included in household contents can vary depending on individual circumstances and lifestyle.

Factors Influencing the Average Value of Household Contents

The average value of household contents is not a fixed number, but rather a range that fluctuates based on several factors. These include:

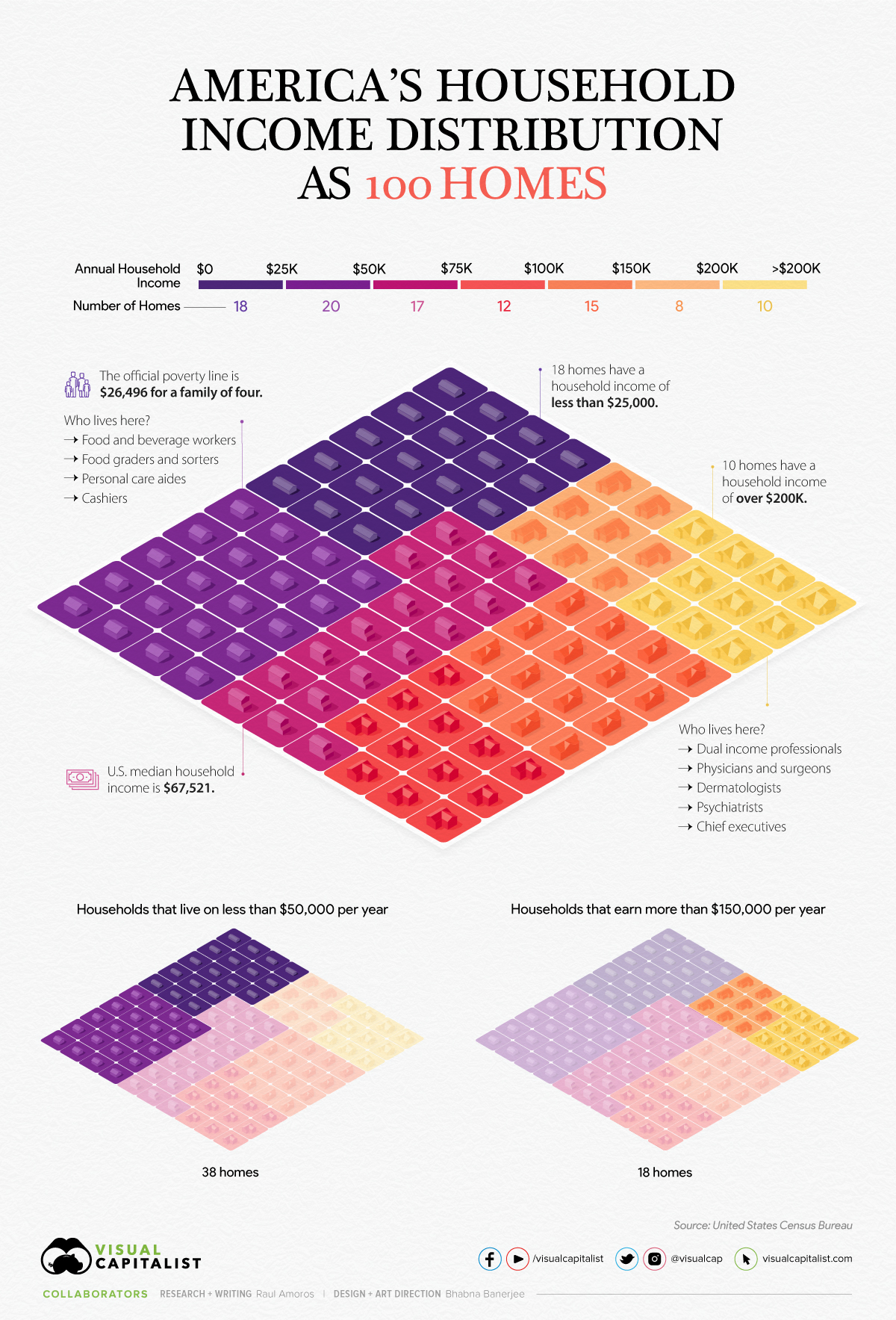

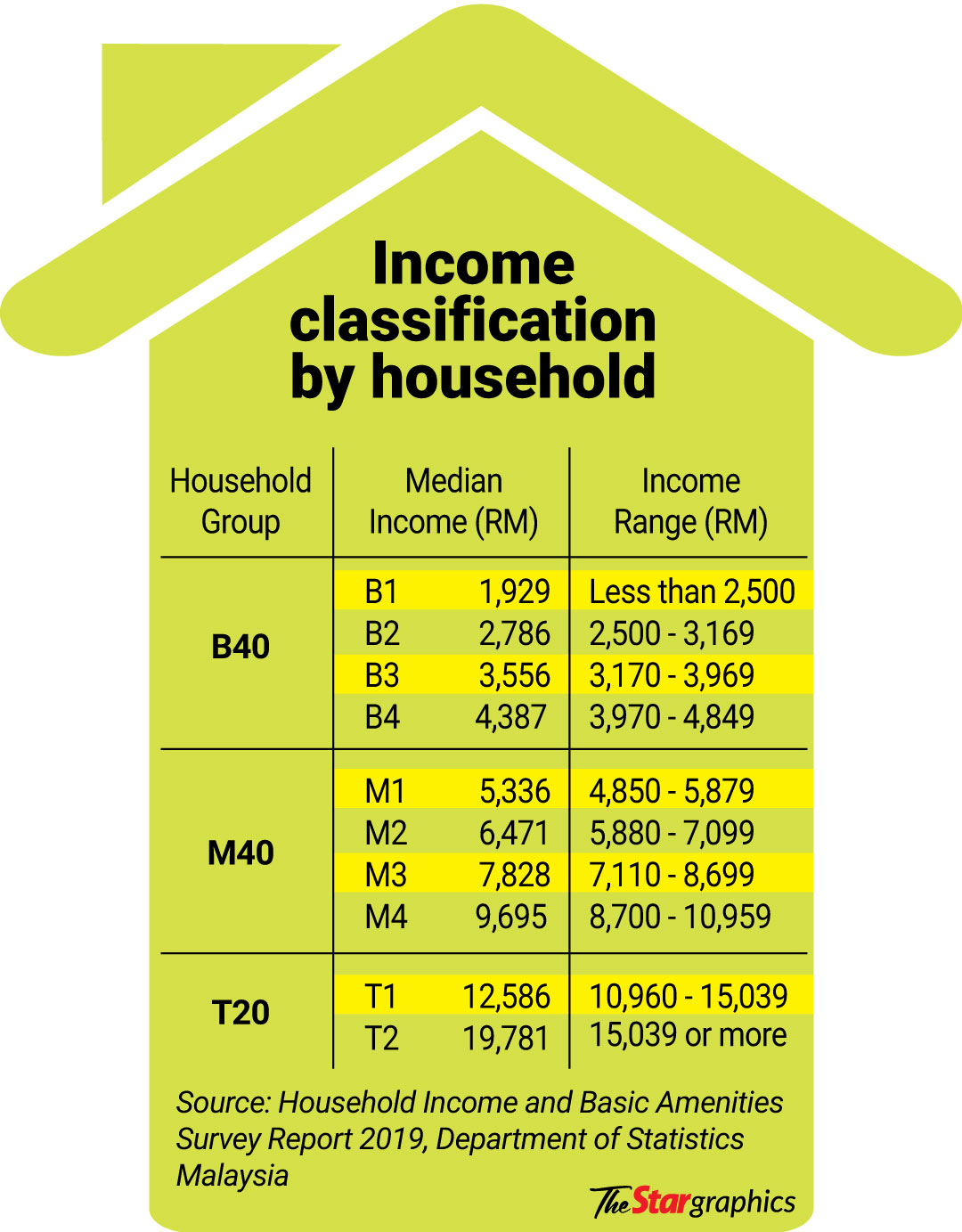

1. Location: The cost of living in a particular area significantly impacts the value of household goods. Homes in urban areas with higher real estate prices tend to have more valuable contents compared to rural areas.

2. Home Size: Larger homes typically house more furniture, appliances, and personal belongings, leading to a higher average value.

3. Age of the Home: Older homes often contain more antique furniture and vintage items that may command higher value compared to newer homes.

4. Lifestyle and Income: Individuals with higher incomes and affluent lifestyles tend to own more expensive items, contributing to a higher average value of their household contents.

5. Ownership of Luxury Items: The presence of luxury items like high-end electronics, designer furniture, and valuable artwork significantly increases the average value of household contents.

6. Personal Collections: Individuals with extensive collections of stamps, coins, books, or other collectibles may have a higher average value of household contents due to the potential value of their collections.

7. Family Size: Larger families generally have more furniture, appliances, and personal belongings, resulting in a higher average value of household contents.

8. Replacement Cost: The average value of household contents is often determined by the cost of replacing the items in their current condition. This can vary significantly depending on the age, brand, and condition of the items.

The Importance of Understanding Average Household Contents Value

Understanding the average value of household contents is crucial for several reasons:

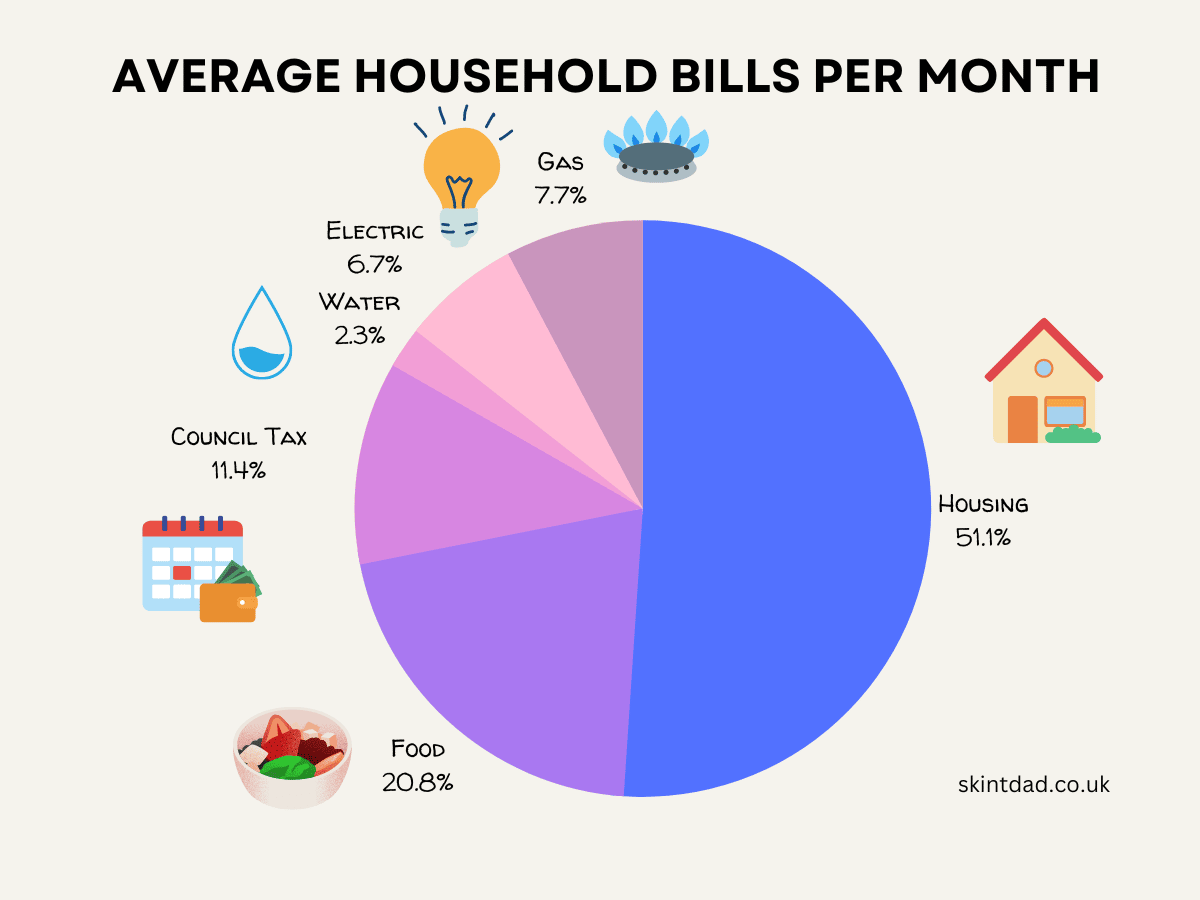

1. Insurance Coverage: Homeowners and renters insurance policies typically cover the replacement cost of household contents in case of damage or loss due to fire, theft, or natural disasters. Determining the average value of contents helps individuals choose appropriate coverage amounts to ensure adequate protection.

2. Financial Planning: In the event of a major disaster or unforeseen circumstances, knowing the value of household contents can assist in assessing financial losses and planning for recovery.

3. Estate Planning: When creating a will or trust, it is essential to accurately assess the value of household contents for inheritance purposes.

4. Loan Applications: Some lenders may require an assessment of household contents value when evaluating loan applications, particularly for secured loans like home equity loans.

5. Financial Literacy: Understanding the value of our possessions fosters financial awareness and helps us make informed decisions regarding our finances.

Estimating the Average Value of Household Contents

Estimating the average value of household contents can be a complex task. However, several methods can be employed:

1. Inventory Method: This involves creating a detailed inventory of all household contents, including descriptions, purchase dates, and estimated replacement costs.

2. Room-by-Room Method: This method involves assessing the value of contents in each room of the house separately.

3. Online Calculators: Several online calculators provide estimates based on factors like home size, location, and lifestyle.

4. Professional Appraisals: For valuable items like antiques, artwork, or jewelry, professional appraisals are recommended to determine their accurate value.

5. Insurance Agent Consultation: Insurance agents can provide guidance on estimating the value of household contents and selecting appropriate insurance coverage.

Frequently Asked Questions (FAQs)

Q: What is the average value of household contents in the United States?

A: There is no definitive average value for household contents in the US, as it varies widely based on factors discussed previously. However, according to recent data, the average value of household contents for homeowners is estimated to be between $50,000 and $100,000, while renters may have an average value of $20,000 to $50,000.

Q: How often should I update my household contents inventory?

A: It is recommended to update your inventory annually or whenever there are significant changes in your possessions, such as purchasing new items or selling existing ones.

Q: Is it necessary to have a detailed inventory of all my belongings?

A: While a detailed inventory is ideal, it is not always practical. At least a general inventory of valuable items and those with high replacement costs is recommended.

Q: What if I have valuable items that are not covered by my insurance policy?

A: You may need to consider additional insurance coverage, such as a rider or floater, to protect valuable items that exceed the standard coverage limits.

Q: How can I protect my household contents from damage or theft?

A: Implementing security measures like alarms, security cameras, and strong locks can deter theft. Maintaining your home and appliances regularly can prevent damage and ensure their longevity.

Tips for Determining and Managing the Value of Your Household Contents

1. Keep Records: Maintain receipts, warranties, and appraisals for valuable items.

2. Take Photos and Videos: Document your possessions with photos and videos for insurance purposes.

3. Regularly Review and Update: Update your inventory and insurance coverage as needed.

4. Consider Specialized Coverage: Explore additional insurance coverage for valuable items like jewelry, artwork, or collections.

5. Consult with Professionals: Seek guidance from insurance agents and financial advisors when necessary.

Conclusion

Understanding the average value of household contents is not just about financial planning; it’s about acknowledging the significance of our possessions and ensuring their protection. By taking the time to assess and manage the value of our belongings, we can make informed decisions about insurance, financial planning, and estate planning, ultimately safeguarding our assets and peace of mind.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Value of What We Own: A Comprehensive Look at Average Household Contents. We hope you find this article informative and beneficial. See you in our next article!