Navigating the Estate: The Inclusion of Household Items in Probate

Related Articles: Navigating the Estate: The Inclusion of Household Items in Probate

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Estate: The Inclusion of Household Items in Probate. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Estate: The Inclusion of Household Items in Probate

The process of probate, the legal administration of a deceased person’s estate, often involves a detailed inventory of assets. While the scope of this inventory can vary depending on the complexity of the estate, a common question arises: are household items included in probate? The answer, while seemingly straightforward, requires a nuanced understanding of the legal framework governing estate administration.

Understanding the Scope of Probate

Probate primarily focuses on the distribution of assets according to the deceased person’s will or, in its absence, the laws of intestacy. These assets are typically classified as "probate assets," which are subject to the probate process and subject to the jurisdiction of the probate court.

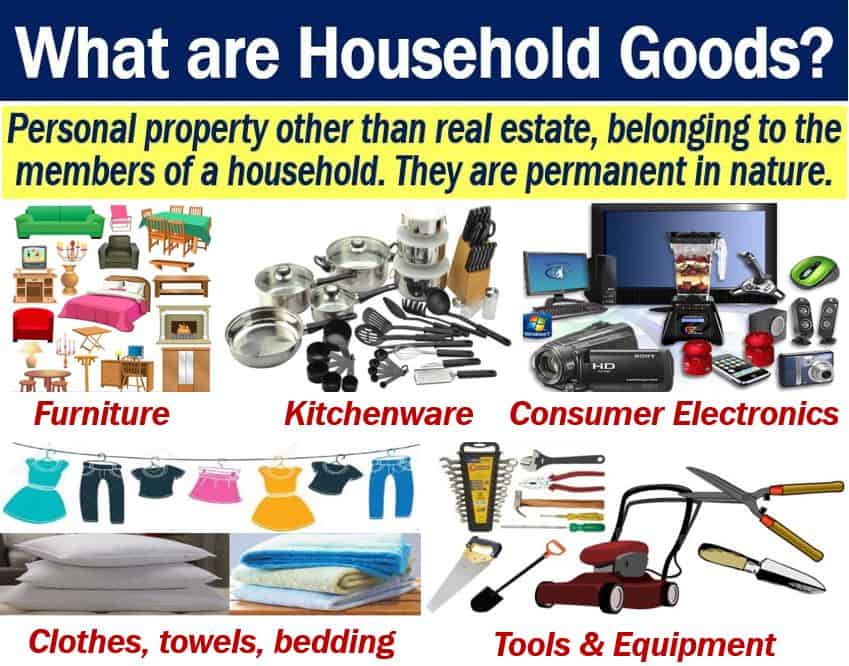

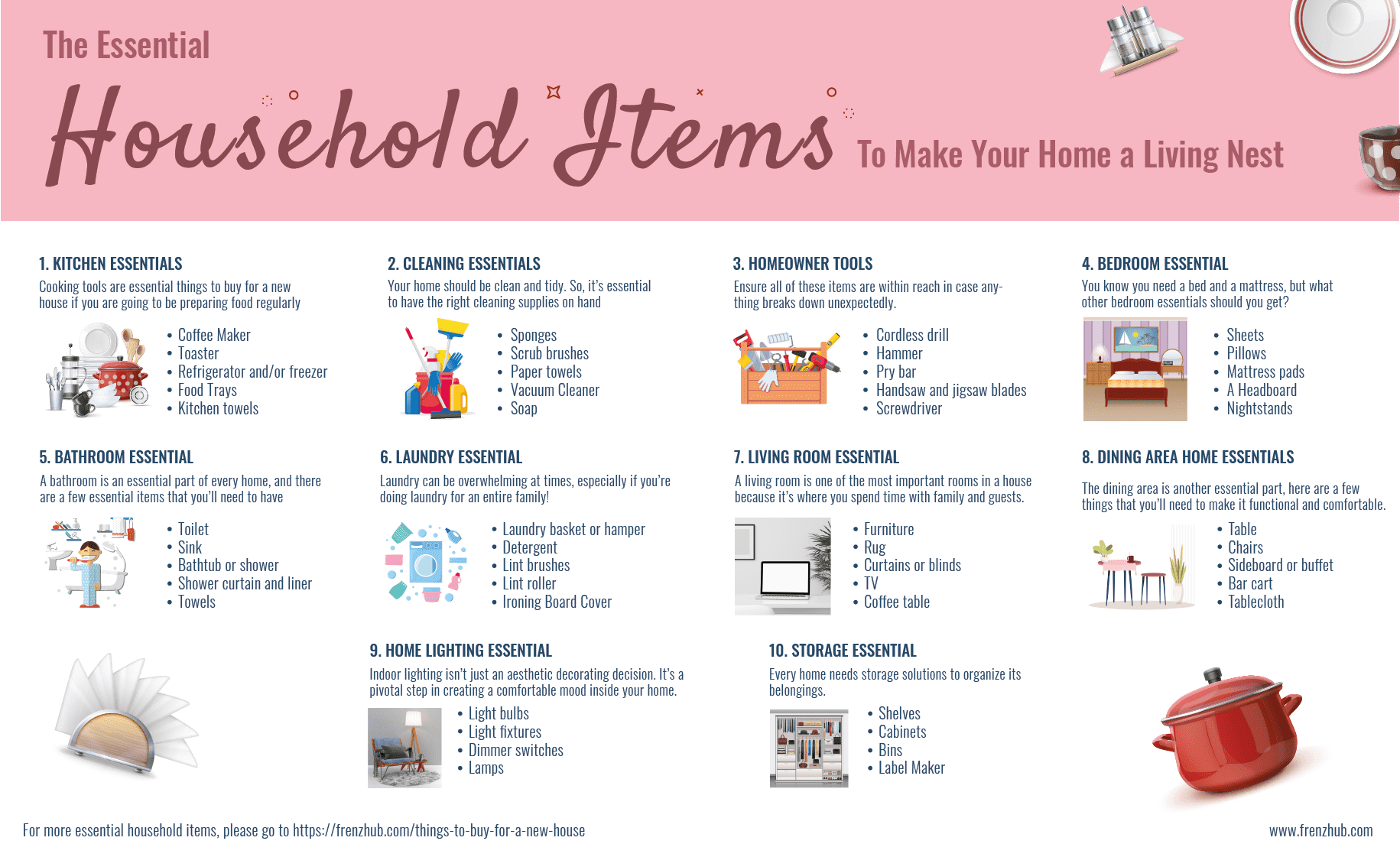

Household items, encompassing everything from furniture and appliances to personal belongings and decorative items, can indeed be considered probate assets under certain circumstances. The key determining factor is the value of these items.

The Threshold of Value

While it may seem intuitive that all possessions should be accounted for in probate, the reality is that the probate process is primarily concerned with assets of significant financial value. Therefore, household items of minimal value are often excluded from probate.

For instance, a worn-out couch or a set of mismatched plates may not be deemed valuable enough to warrant inclusion in the probate inventory. These items are often considered "personal property" and may be disposed of or distributed informally by the executor or administrator of the estate, without the need for formal probate proceedings.

Exceptions to the Rule

However, there are exceptions to this general rule. Certain household items, even if seemingly commonplace, can hold substantial value and therefore become subject to probate. This value can be intrinsic, such as a family heirloom with historical significance, or extrinsic, such as a rare antique or a piece of art with market value.

Consider these examples:

- Antiques: A vintage grandfather clock or a set of antique silverware can command significant prices in the market, making them subject to probate.

- Artworks: Paintings, sculptures, or other forms of art, even if not renowned, can hold considerable value and require proper appraisal and distribution through probate.

- Collectibles: Stamps, coins, or other collectible items, especially those with proven rarity or historical significance, can be valuable assets requiring probate.

- Jewelry: Fine jewelry, especially pieces containing precious metals and gemstones, often falls under the purview of probate due to their inherent value.

The Importance of Proper Valuation

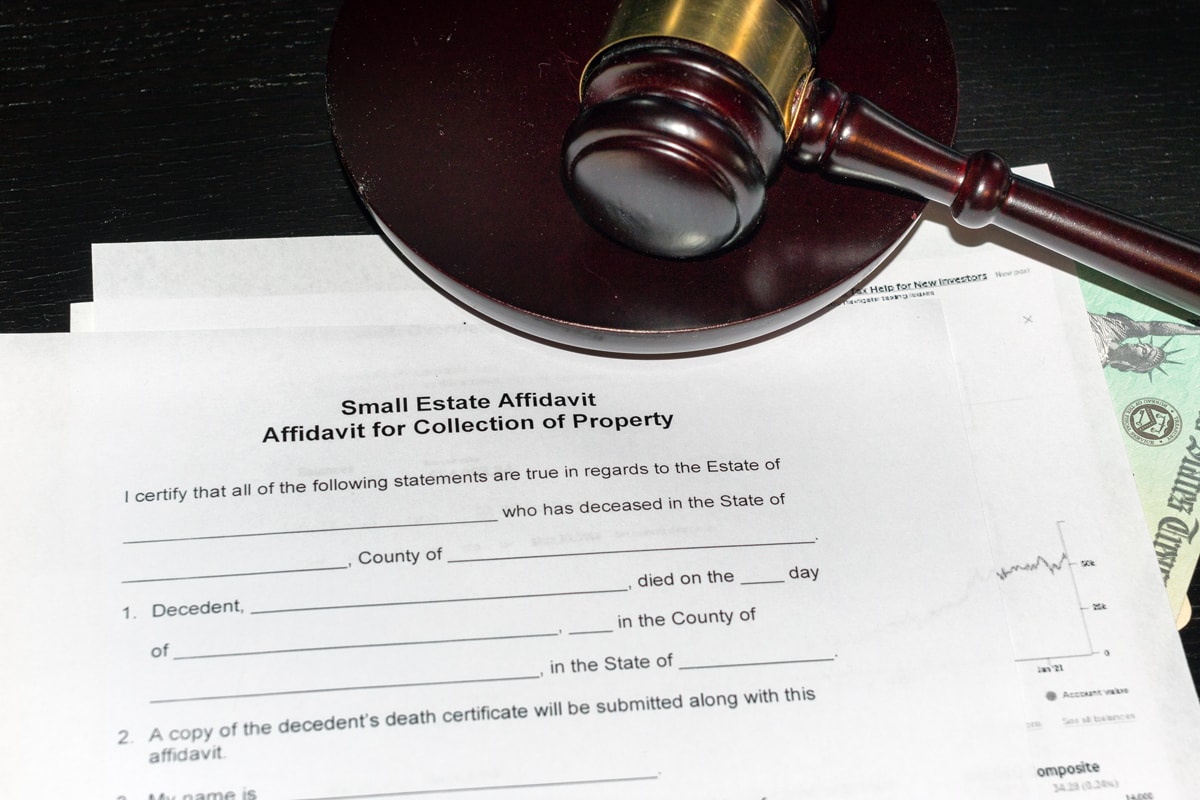

The value of household items is a crucial factor in determining their inclusion in probate. Accurate valuation is essential for fair distribution to beneficiaries and for calculating any inheritance tax liability.

In many cases, professional appraisers are engaged to provide unbiased and accurate valuations of valuable household items. This ensures that the estate is properly accounted for and that beneficiaries receive their rightful share.

The Role of the Executor or Administrator

The executor or administrator of the estate is responsible for identifying and valuing all assets, including household items. They must exercise due diligence in determining which items should be included in probate.

In cases where the value of household items is uncertain, the executor may consult with legal counsel or an estate planning professional to seek guidance on their inclusion in probate.

Navigating Probate with Household Items

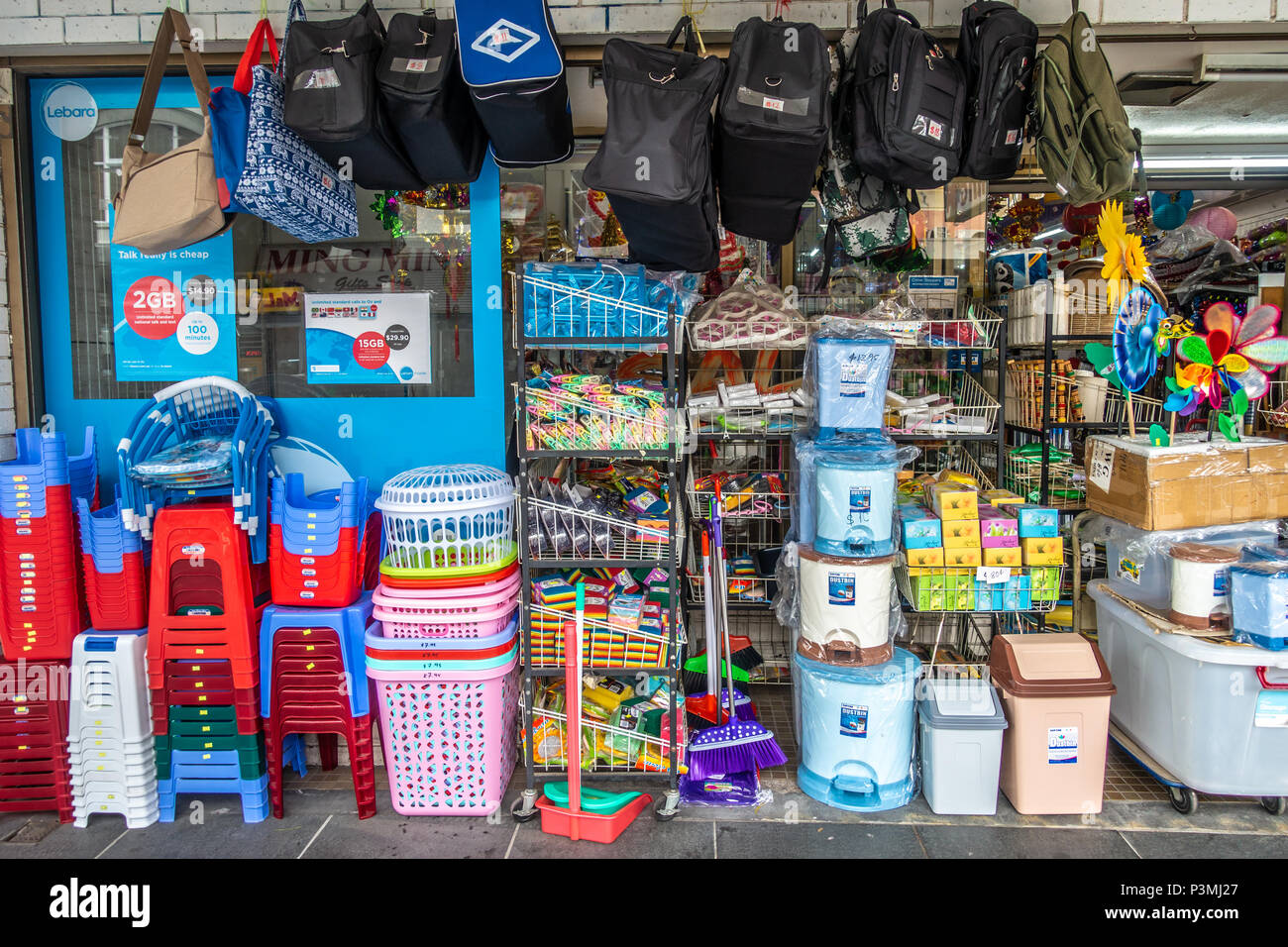

The inclusion of household items in probate can add complexity to the process. It requires careful inventorying, valuation, and distribution, which can be time-consuming and potentially contentious.

Here are some key considerations:

- Inventory and Documentation: Maintain detailed records of all household items, including descriptions, condition, and any supporting documentation such as purchase receipts or appraisals.

- Valuation: Seek professional appraisal for items of significant value to ensure accurate assessment and fair distribution.

- Distribution: Clearly outline the intended recipients of specific household items in the will or through a separate document.

- Communication: Maintain open and transparent communication with beneficiaries regarding the process of identifying, valuing, and distributing household items.

FAQs about Household Items in Probate

1. Are all household items subject to probate?

No, only items of significant value are typically included in probate. Everyday items of minimal value are often excluded.

2. How do I determine if a household item is valuable enough for probate?

Consult with an estate planning professional or a qualified appraiser to determine the value of the item.

3. What happens to household items not included in probate?

These items are typically disposed of or distributed informally by the executor or administrator of the estate.

4. Can I exclude specific household items from probate in my will?

Yes, you can designate specific items to be distributed outside of probate. However, this may require legal counsel to ensure proper execution.

5. What are the potential consequences of not including valuable household items in probate?

Failure to include valuable items could result in unfair distribution to beneficiaries, potential tax liabilities, and legal disputes.

Tips for Including Household Items in Probate

- Inventory Early: Begin compiling an inventory of household items as soon as possible to ensure accurate documentation.

- Professional Appraisal: Engage a qualified appraiser for items of significant value to avoid disputes and ensure fair distribution.

- Clear Distribution: Clearly specify the intended recipients of specific items in the will or through a separate document.

- Communication is Key: Maintain open and transparent communication with beneficiaries throughout the process.

Conclusion

The inclusion of household items in probate is a nuanced aspect of estate administration. While everyday items of minimal value are often excluded, items with significant intrinsic or extrinsic value require careful consideration.

By understanding the legal framework, the significance of valuation, and the role of the executor or administrator, individuals can navigate the process of including household items in probate effectively. This ensures that the deceased person’s wishes are honored, assets are distributed fairly, and potential legal complications are avoided.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Estate: The Inclusion of Household Items in Probate. We thank you for taking the time to read this article. See you in our next article!

![15 Best Meats to Smoke for Beginners [+ Tips from a Chef]](https://cheftravelguide.com/wp-content/uploads/2022/05/smoked-meats-in-smoker.jpg)

![A Guide to Understanding the Digital Marketplace [Infographic]](https://infographicjournal.com/wp-content/uploads/2019/08/A-Guide-to-Understanding-the-Digital-Marketplace.jpg)